Covid-19 Vs Spanish flu and stock market crash

ARTICLE NO : 8

Is the worst for equity markets over?

Global equity markets have witnessed a major sell off due to the SARS CoV 19 pandemic. At the last count more than 2 Million people (about 0.025% of the total population) world over have been infected by COVID 19 virus resulting in more than 100,000 deaths. Currently many countries are under some form of a lockdown. This has brought all but the essential economic activity to a complete halt. The uncertainty surrounding the earnings visibility over the near term explains the volatility levels in the global markets. This begs the question: how does one go about investing during this crisis?

Should one buy into the fall in multiple tranches or all at once? Or, even better, wait for the dust to settle and buy when there is a vaccine or a cure for the pandemic?

As Mark Twain says, History never repeats, but it rhymes. Therefore, it is useful to look at the behavior of the markets during previous pandemics.

Spanish Flu (1917 – 1918) and its impact on the markets

Spanish flu was one of the deadliest pandemics in modern history. It infected a total of 500 million people (about 33% of the world population) and caused 20 – 50 Million deaths. The Spanish flu killed about 675,000 people in the United States alone. The first wave of the infection was pretty mild, with infected people experiencing flu-like symptoms and most people recovered from the infection. But the second wave was deadly with victims dying within hours of the infection

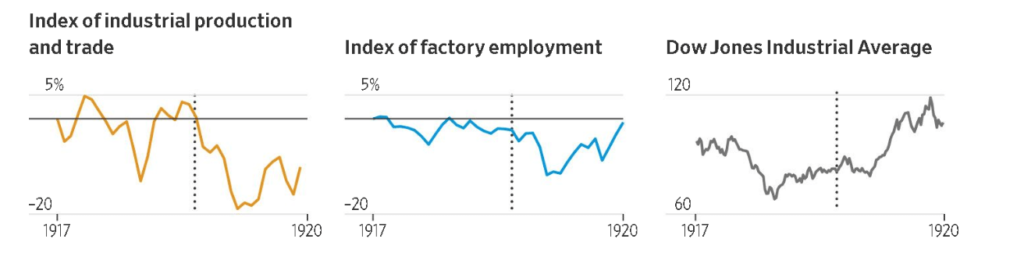

The worst impact of the spanish flu was most seen during October 1918. However, the stock market crashed by more than 33% in December 1917, as a reaction to the initial set of infections caused by the spanish flu .

Also notice that subsequently when the Spanish flu was having its worst impact in October of 1918, the market was already up more than 35% from the bottoms of December 1917. The full recovery of industrial production (see figure below) and trade took nearly 3 years. However, by then the Dow jones had surpassed the previous highs by around 20%. In other words, the market had discounted the worst impact of the Spanish flu in terms of health and economic activity several months in advance. If there is one takeaway from all this: it is that markets and economic activity generally are not in perfect phase. The markets typically lead the economic activity by a few months and markets discount both upside and downside well in advance.

Comparison between Spanish flu and covid-19

If we extrapolate the impact of Spanish flu for today’s world population, the number of infected people would be approximately 3 Billion with 120 – 300 million fatalities. As it stands ( and in many places around the globe, the infection curve has started to “flatten”), Covid 19 pales in comparison with the impact that Spanish flu had. However, one cannot underplay the risks that COVID-19 poses — the world population mixes much more today than during the 1900s, the infection spreads rather rapidly. However, with unprecedented social distancing measures and greater awareness coupled with rapid advances in medical sciences it is more or less certain that the % of the world population infected and % of fatalities will be much lesser than that of the Spanish flu.

Sell off in the equity markets due to covid 19

The first reports about COVID virus starting appearing in early January (before the chinese new year). However, the world markets barely reacted to the infection until mid February. In fact, around February 20th the US markets hit an all time high.

As it became clear that the COVID 19 virus was not yet another flu virus that can be contained with a flu shot, the markets started reacting. Subsequently there was a huge sell off around the globe. The circuit breaker was triggered multiple times in the US with more than 7% fall in the indices. India’s sensex and nifty had their own share of sell offs — there was a lower circuit and then a 8-10% bounce back the same day! Volatility levels were incredible highs. To add to the chaos, there was an oil price war between Saudis and Russians due to disagreement over the oil production rates. This resulted in a hammering for shale stocks in the US. All forms of travel and hospitality industries took a big hit because of the huge number of cancellations. The Indian stock market was down nearly 40% from its highs.

Conclusion:

Since March 23rd, however, with the worst being factored in and hopes of controlling the COVID virus, the world markets have rallied more than 20 % from the bottom. Now the question is — is the worst over? Or will we see a further downside?

If history is anything to go by, markets invariably discount events several months in advance. As we saw during the spanish flu (probably the best parallel we have to COVID 19), when the health impact was the worst, the market was actually already up more than 35% from the bottom. If that is an indicator, then the worst might be over and the rally which we are seeing world over might not just be a bear market rally. Instead we might be in the recovery phase. However, on the economic front, we do not know what is the scale of destruction caused by the COVID 19 virus. Hence one cannot completely rule out a sharp fall and retesting of the lows. But if history is anything to go by, the worst might be already behind us!

Are you invested fully or waiting for more correction? Let me know in comment below.

Join Investors community to know more about specific stocks and check out books you can read on investing.

Regards,

Shashank