Company Overview

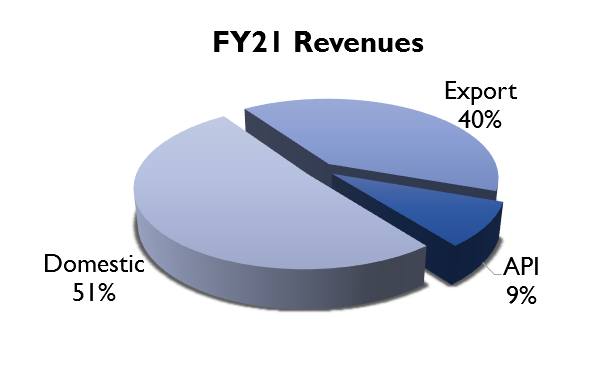

Indoco Remedies is a pharmaceutical company that develops and manufactures a wide range of drug products for sale in the domestic and exports market. In the domestic market, they have several brands like Cyclopam, Febrex Plus, Sensodent-K, Karvol Plus, ATM, etc. which are leaders in their respective therapeutic areas. Indoco generates 7 crore prescriptions annually from over 3 lakh doctors from various specialties. In the export markets, they have various partnerships through which they sell their products in 55 countries. They are also involved in manufacturing and sale of APIs and they have a CRO vertical called AnaCipher through which they offer certain research and analytical services.

Geographical Presence

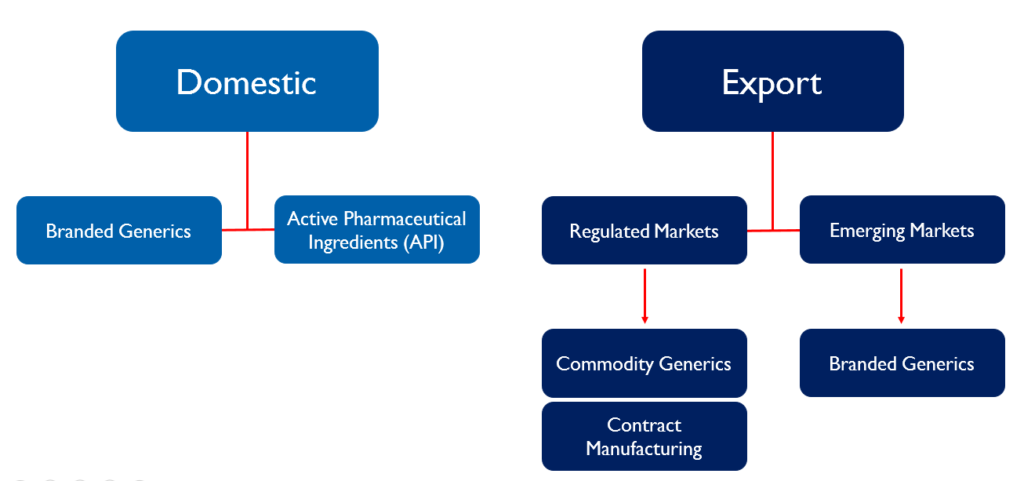

The company’s business can be divided into domestic and export. In the domestic market, they sell branded generics under their own brand name by generating prescriptions. They also sell APIs to other formulation companies in the domestic market.

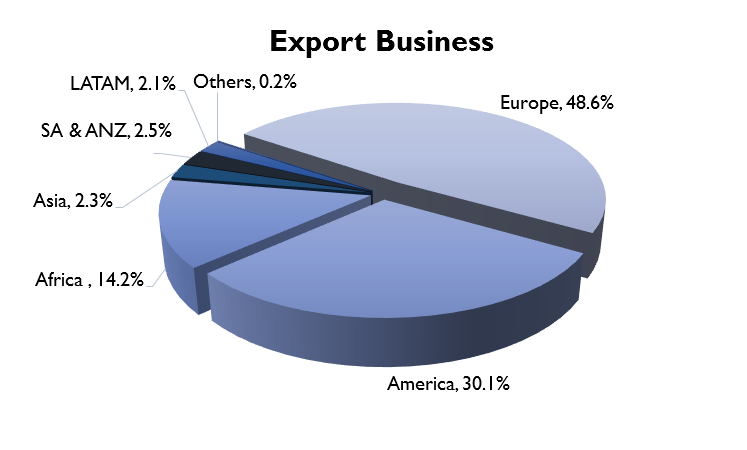

Their export business can be further divided into regulated markets and emerging markets. In the regulated markets, they sell their products through various partnerships. In the US, the company has a partnership model where they manufacture the drug and it is sold through a partner and they get a share of the profit. (eg. they have a partnership with Teva for manufacturing Brinzolamide). In Europe (mainly UK and Germany), they follow a contract manufacturing model where they produce drugs for other formulation companies.

In the emerging markets, they sell branded generics in Africa, Asia, CIS and LATAM. They have their own field force in parts of West Africa, Kenya, Sri Lanka and Myanmar. They follow a distributor model for the rest of the emerging markets.

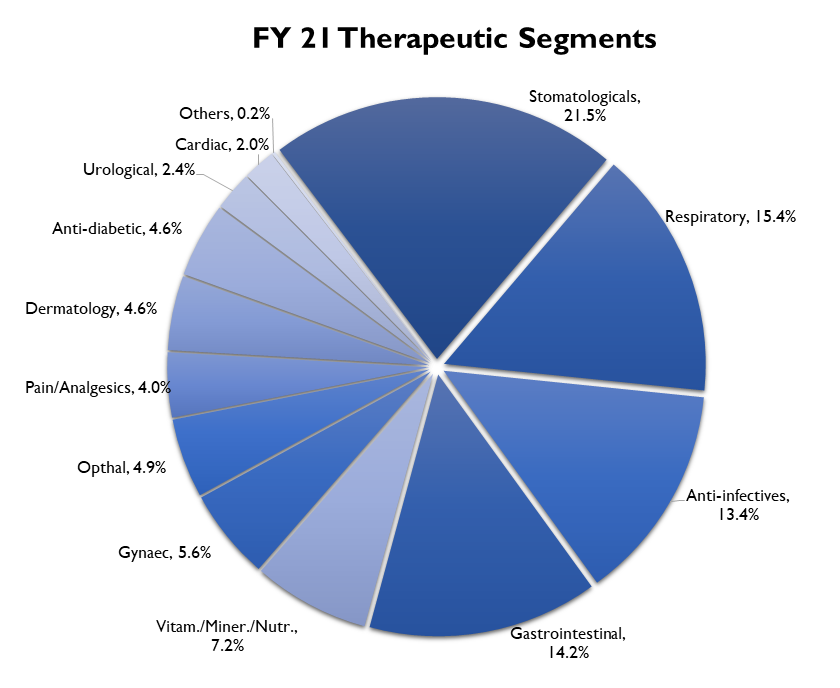

Therapeutic Areas

In the domestic market, the company’s main therapy areas are stomatologicals, respiratory, anti-infectives and gastrointestinal. These 4 therapies together account for about 65% of the company’s revenues. Apart from these, the company offers a range of therapeutic areas like gynecology, ophthalmology, women’s health, nutritional products, cardiology, metabolic disorders and primary care medicines.

Manufacturing Facilities

Indoco has a total of 9 manufacturing facilities – 6 for formulations and 1 for API. They also have a kilo lab at their R&D Center in Rabale and CRO in Hyderabad called AnaCipher. The facilities have been approved by most of the Regulatory Authorities including USFDA and UK-MHRA

Regulatory Headwinds

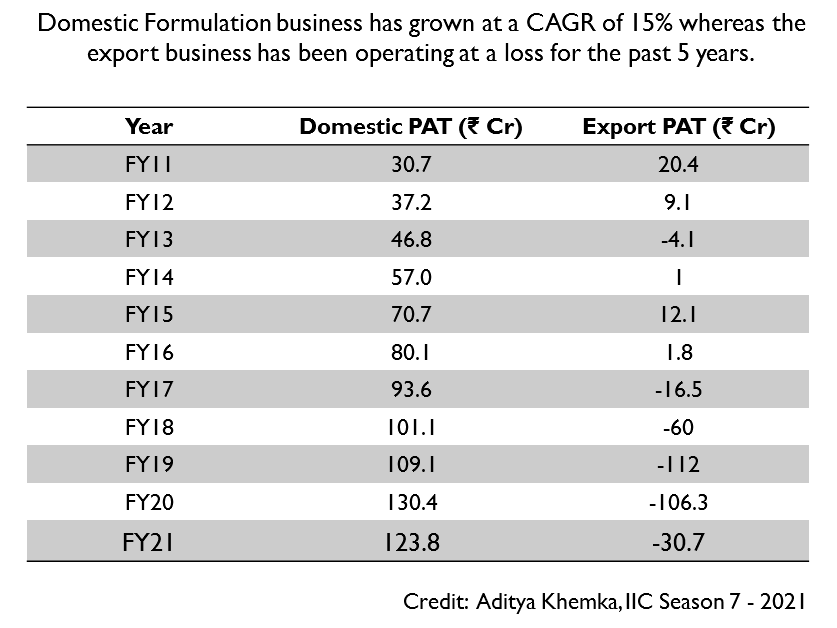

The company has faced significant regulatory headwinds in their export business. They received a warning letter from US FDA in 2017 for their Goa Plant 2 due to Ophthalmic Product Leakage. Soon after that, they also received a restricted GMP status from UK-MHRA. Then in 2019, they received a warning letter for Goa Plant 1.

So sales to the company’s main export markets were halted. This made the export business unprofitable as they were bearing a lot of idle costs for facilities that were generating no revenues.

Usually when a company receives a warning letter from the US FDA, it takes 2-3 years to resolve the matter. The company received clearance from the US FDA for Goa Plant 2 in FY21 and the losses decreased. FY22 was the first year where the Goa Plant 2 was fully operational. Goa Plant 1 is still in OAI status and is expected to receive clearance in a few quarters.

Operating Leverage

The company is expected to have operating leverage in 3 key areas:

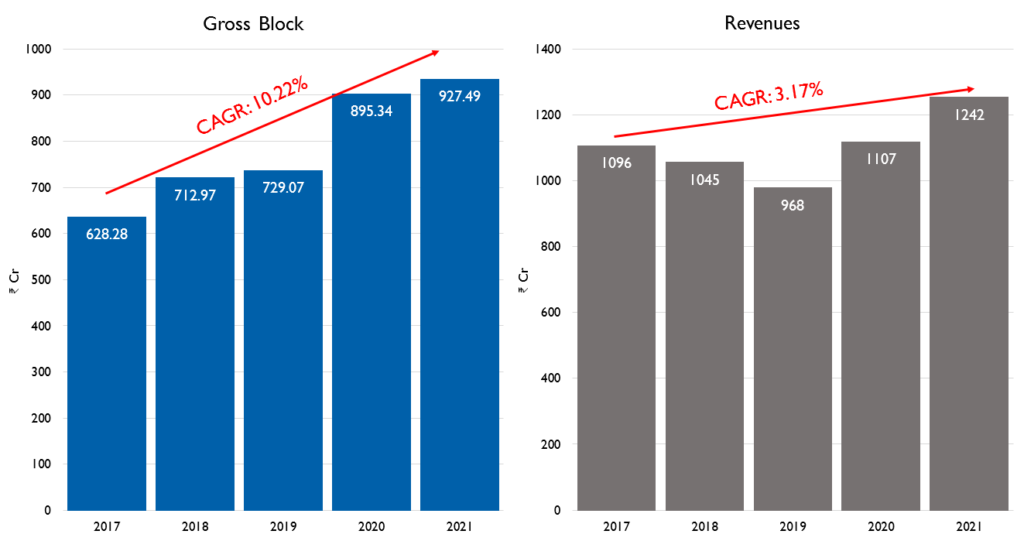

- Manufacturing Facilities: The company’s Goa Plant 2 is fully operational for US sales and Goa Plant 1 is expected to be fully operational in a few quarters. The company’s gross block has grown at a CAGR of 10.22% from FY17 to FY21 whereas the revenues have stayed mostly flat. The management has said that they will not be doing any major capex for the next 2 years.(Insert Pic 8)

- MR Productivity: The company has one of the lowest MR productivity among domestic companies. They currently have a field force of 2300 and the management has indicated that they will not be adding any more but will be focusing on increasing per man return. Their MR productivity was about ₹2.6 lakhs in FY21 which has touched ₹2.8 lakhs in Q3 FY22. They will be crossing ₹3 lakhs in FY23. (Insert Pic 9)

- Outsourcing: The company has said that the products in their India portfolio can easily be outsourced. Currently, they are manufacturing these products in Baddi to utilize that capacity. But as the export business grows, they will be utilizing the entire capacity at Baddi for exports to Europe. The Goa facilities will be used entirely for the US and the Indian products will be outsourced. This will enable them to move to an asset light model for the domestic formulation business.

Financials

After receiving the warning letter for the first facility, the company’s revenues and profitability started declining. FY19 was their worst year where they posted a loss. The company has been able to improve margins every year since then and in FY21 net profit crossed FY15 levels.

The management had guided for revenues of ₹1600 Cr for FY22 with EBITDA margins of 19-20% and ₹300 Cr+ of cash generation. Due to disruptions in their business in Q2 and Q3, they will be falling just a little short of the guidance. Management has said that the business will be firing on all cylinders in FY23 and it is expected to be their best year yet.

Future Outlook

In the domestic market, the company is making a shift towards chronic and sub-chronic therapies. Currently a majority of their revenues come from acute therapies which have lower stickiness and have a seasonal effect. Chronic products will help bring in more persisting earnings and higher margins. Of the 9 new products launched in FY21, two are in the acute, one in sub-chronic and six in the chronic segment.

The company has recently launched Lacosamide injection in the US – which is a complex generic. The company’s strategy is to manufacture complex products with lower competition and sell it through a partner like Teva. This business had suffered due to the regulatory issues faced by Indoco, but the company is set to launch 2 products in the US in FY23 and then 2 more in FY24. They will also be signing new partnerships in the US with more favorable profit splits.

The company has also incorporated a new subsidiary in the UK and will be selling their own brands. The company followed a contract manufacturing model until now for Europe and selling their own products would improve margins for this business dramatically.

Risks

Some of the key risks in the business are:

- Future regulatory issues: If the company has any further regulatory issues at their manufacturing plants, it would increase costs in the export business for another 2-3 years.

- Loss in demand for key products: The domestic business generates most of its revenues from a few key brands. Any drop in their demand would impact their revenues.

- Rise in prices of APIs from China: Although the company is backward integrated for its US business, the domestic formulation business is highly dependent on API imports from China. During Q3 of FY22, the company had to suspend sales of Paracetamol-based products due to high prices of the API. Any disruptions in China could negatively impact their domestic business which is their cash cow.

- Acute vs chronic mix: The company currently has a high exposure to acute therapies. Their lower exposure to chronic increases risk as some of the acute products in their portfolio are seasonal. The company is however reducing this risk by launching new products in the cardiac and anti-diabetic segment.