- Manorama Industries is engaged in manufacturing cocoa butter equivalents (CBE), butter products & other related by-products from the waste products like sal seeds, mango kernel etc

- Manorama is one of the pioneers in manufacturing specialty fats and butters from tree-borne and plant-based seeds and nuts.

- They are one of the world’s largest producers and suppliers of specialty fats and butters made from exotic seeds and nuts such as mango kernels, sal seeds, and shea nuts, among others, to the premium food, chocolate and confectionery segment as well as cosmetic conglomerates.

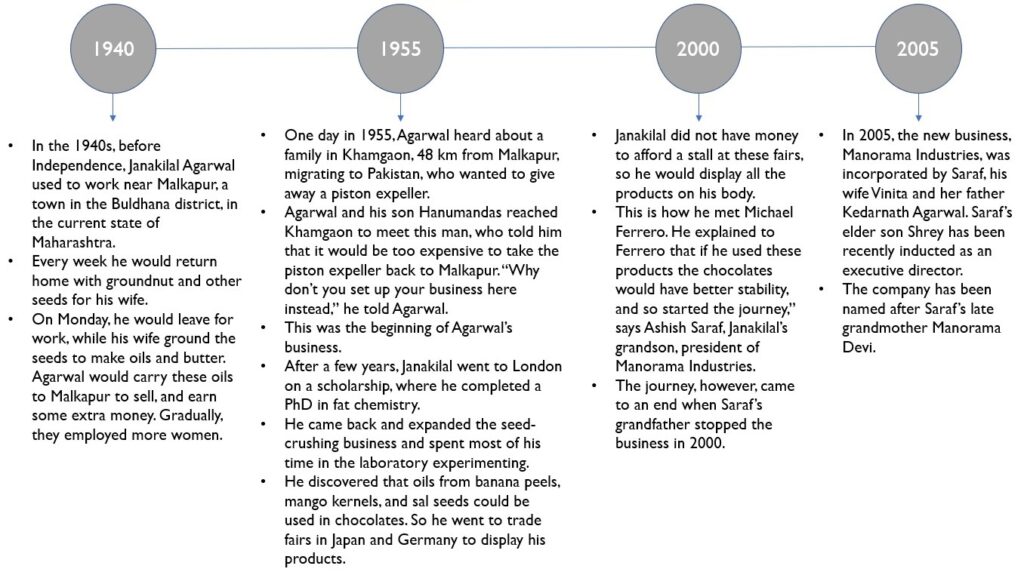

How the business started

Exit from the trading segment

Earlier the company was into trading activities of agro based commodities such as rice, maize, soya etc. The company generated 71.78%, 60.24% and 57.22% of total revenue from operations from its trading activities for the year ended March 31, 2018, 2017 and 2016 respectively. However they generally experienced loss on such trading activities. The company earlier harboured the ambition of becoming an agro-product trading house along with manufacturing. However, the trading business could not yield results as envisaged by the management. As a part of the future business strategy, the company won’t pursue the trading business going forward.

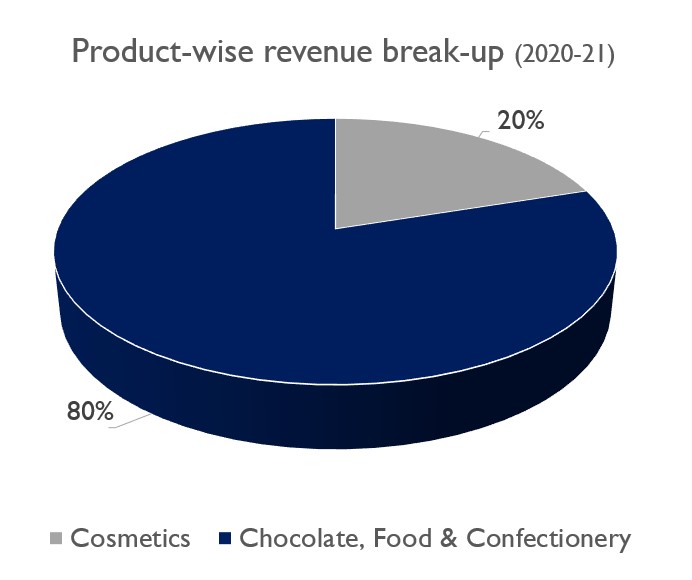

Business segment contribution

The company has 2 business segments:

- Chocolate, Food & Confectionery

- Cosmetics

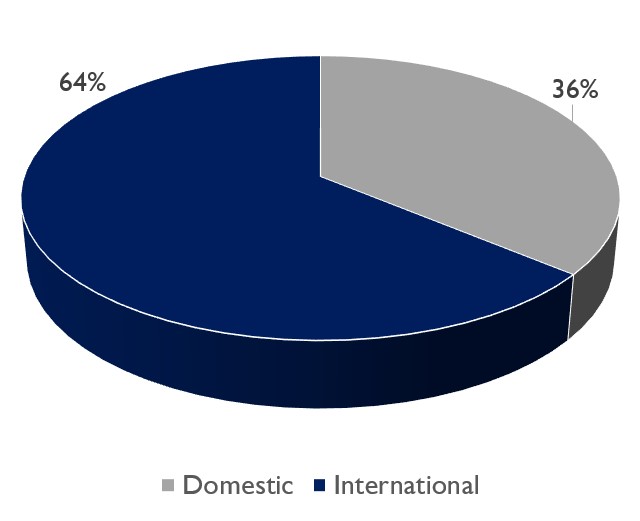

Geographical Mix

During 2020-21, Manorama expanded their global reach further to add new customers to their portfolio which transpired through their higher export revenues.

- India: 36% in FY21

- Outside India: 64% in FY21

Clientele

The company has a strong clientele with the world’s leading confectionery & cosmetic brands, like Ferrero, Mondelez, The Body Shop, L’Oréal, Unigra, Mitsui, Walter Rau, etc., sourcing its products.

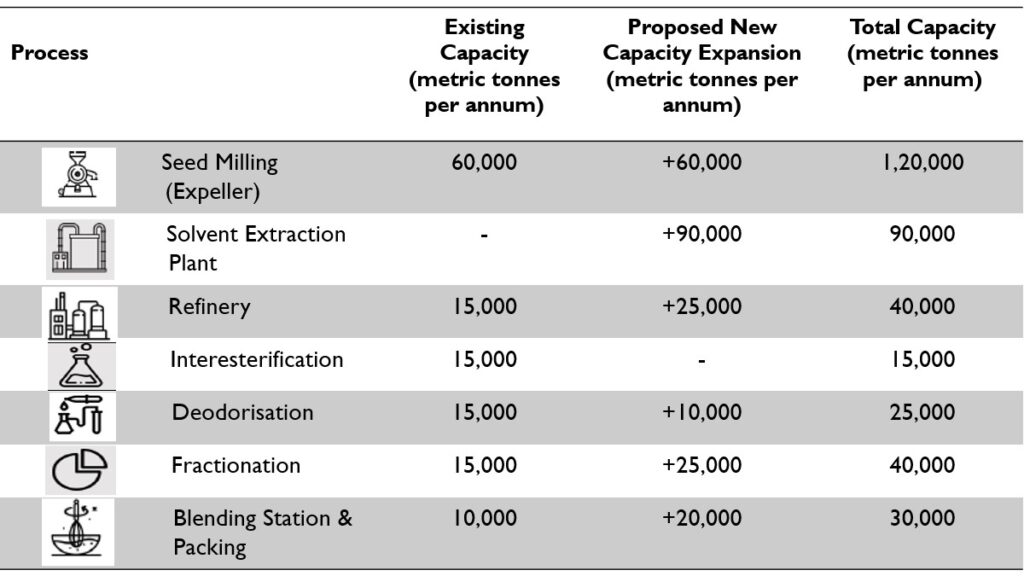

Capacity Expansion

The company has newly set up state-of-the-art integrated manufacturing plant at Birkoni, near Raipur. This is an integrated plant with all facilities inplace-crushing, extraction to refining and fractionation. The commencement of the commercial operations at this plant has propelled the company to become a leading Indian manufacturer in the global CBE and specialty fats and butter industry.

The company has commenced expansion and construction activities for setting up its new solvent extraction plant at Birkoni and is in the process of identifying and closing the vendors and suppliers of machines and technologies and other related activities.

Focus on R&D

Milcoa Innovation & Research Center is a high standard research laboratory equipped with cutting-edge technologies. The company’s R&D team is led by Dr. Krishnadath Bhaggan.

A Ph.D holder, Dr. Krish joined Manorama on January 1, 2019. With his support, the Company has been recognised for its R&D efforts by the Government of India’s Department of Scientific & Industrial Research (DSIR).

He has worked for Bunge Loders Croklaan in R&D and Innovation for more than 21 years. Bunge Loders Croklaan is a leading global producer and supplier of sustainable premium quality vegetable oils and fats for the food manufacturing industry.

He is an expert in oils and fats modification and has experience in developing specialty oils and fats for different food categories such as chocolate, confectionery, bakery, savory, culinary and others. He is also inventor/co-inventor of more than 70 patents and author/co-author of more than 20 publications in the oils and fats genre.

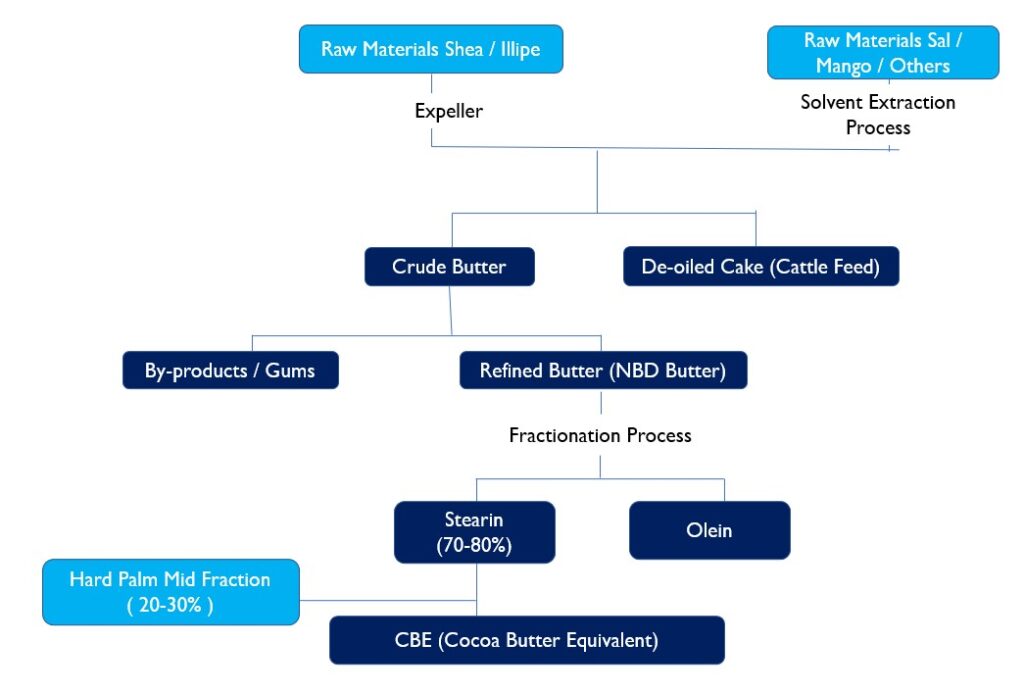

Manufacturing Process Value Chain

- Raw Materials such as Shea/Illipe go through the expeller & raw materials such as Sal/ mango and other exotic seeds go through the solvent extraction process to form crude butter and deoiled cake. Solvent extraction is basically a process of separating impurities from a compound and getting a desired compound.

- Deoiled cake is the byproduct sold as cattle feed. Crude butter is an unrefined butter which means no chemicals have been used during extraction.

- Crude butter is then refined through a refinery process to get fatty acids/gums and refined butter (NBD Butter). NBD Butter is Neutralized, Bleached & Deodorized fat extracted & processed by solvent extraction method.

- Fatty acids/gums are supplied to cosmetic companies as an ingredient for skincare products.

- Then the refined butter goes through the fractionation process to get Stearin and olein. Olein again finds application in skin care products

- Then Stearin (70-80%) and palm mid fraction (PMF) (20-30%) together go through a blending process to get the final product Cocoa Butter Equivalent (CBE). Palm mid fraction (PMF) is a fraction of palm oil which is high in POP triglyceride.

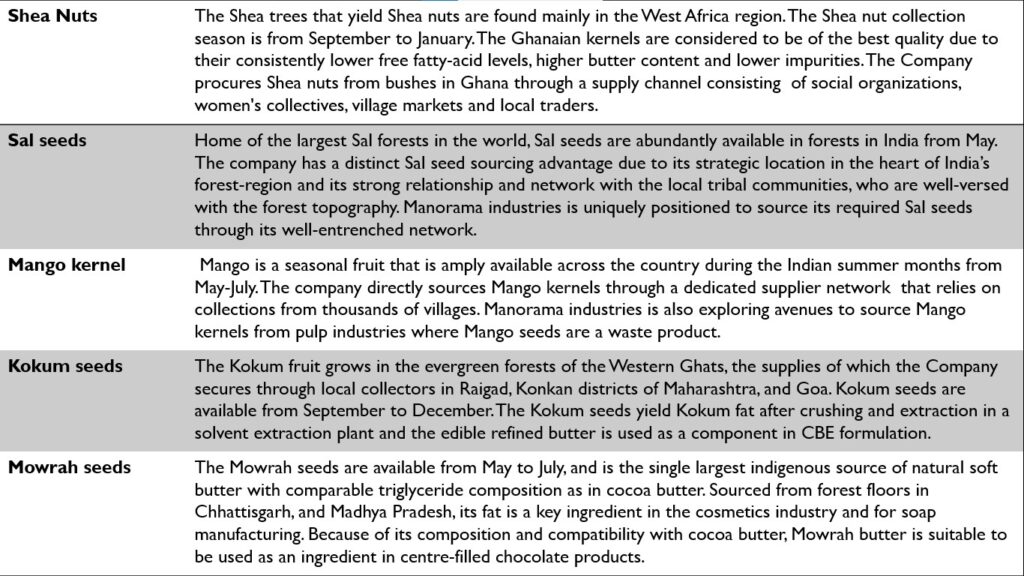

Key Raw Materials

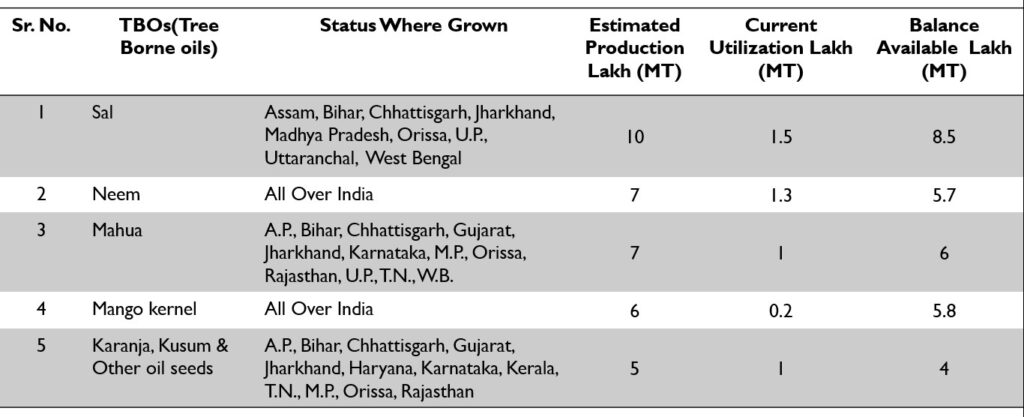

Estimated Production and current utilization of raw materials used

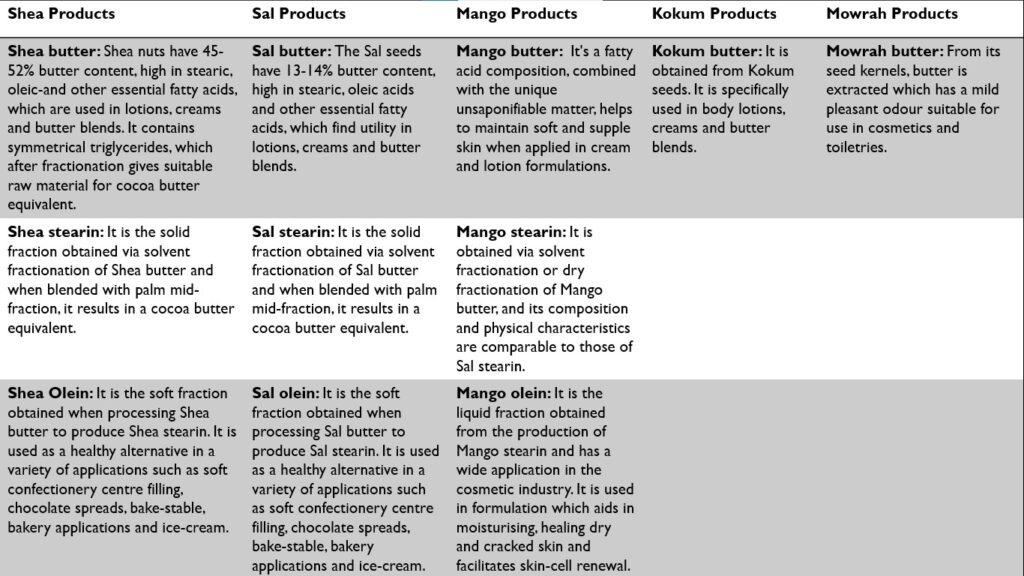

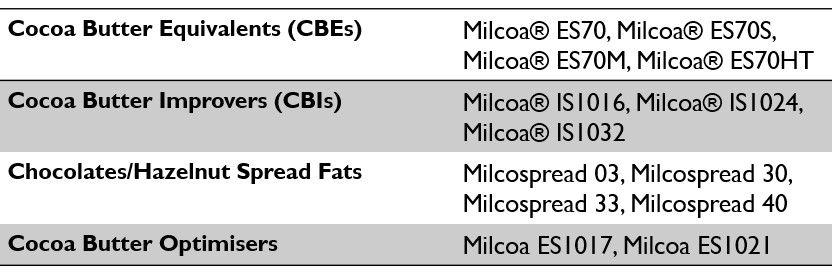

Key Product Portfolio

Significant scope for business growth

FSSAI has allowed the use of 5% CBE in chocolates from January 2018 (from the earlier limit of 2.5%). This should lead to an increase in the consumption of CBE from 8,000 MTPA in 2018 to more than 20,000 MTPA by 2022. In developed markets the permissible limit is 10% and if the same is allowed in India, it will open up significant scope for growth to Manorama Industries.

Cocoa Butter Equivalent (CBE) Market

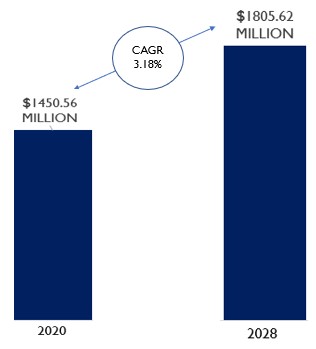

Cocoa Butter Equivalent (CBE) Market size was valued at USD 1450.46 Million in 2020 and is projected to reach USD 1805.62 Million by 2028, growing at a CAGR of 3.18% from 2021 to 2028.

Cocoa butter is a key component in the production of chocolate. It’s hard, moldable, and brittle at room temperature but fully melts at oral temperature. Cocoa butter also has several drawbacks, such as a limited tolerance for milk fat, a lack of stability at high temperatures, and a tendency to bloom.

The cocoa butter equivalent, on the other hand, lowers the cost of chocolate production because it is less expensive than cocoa butter. The Cocoa Butter Equivalent (CBE) Market is primarily driven by the increase in demand for chocolates and the high price of cocoa butter.

Global Cosmetics Industry

The global cosmetics industry comprises skin care products, hair care products, deodorants & fragrances and makeup & colour cosmetics. It has been segmented on the basis of category, gender, distribution channel, and region. The worldwide cosmetics market was valued at USD 380.2 billion in 2019 and is expected to register a CAGR of 5.3 % from 2021 to 2027, reaching USD 463.5 billion.

Global specialty fats and oils market

Specialty Fats and Oils Market Size in 2019 is estimated to be $19.17 Billion and is projected to grow with a CAGR of 6.4% during the period of 2020-2025.

Shortenings and specialty oils, such as cake oils, are increasingly used to enhance product performance and ensure higher consumer acceptance. These factors have accelerated the growth of this segment.

The increasing gap between demand and supply of cocoa butter in the confectionery and chocolate industry is met by the production of specialty fats. Moreover, the rising awareness about the benefits of consumption of good fatty acids is a key driver for the growth of the specialty fats and oils market.

Asia-Pacific is one of the major markets for specialty fats and oils. The demand for specialty oils and fats in the region is likely to remain concentrated in China and India, owing to a large consumer base and application in the countries.

COMPETITORS

- AAK Kamani

- Wilmar International.

- 3F Industries

AAK Kamani

AAK Kamani Private Limited is one of the leading manufacturers in the field of specialty oils and fat products in India. Being FSSC 22000 certified, AAK Kamani specialize in the applications for Food, Pharma, Cosmetic and Nutraceutical industry. KAMANI products include a whole range of specialty vegetable oils such as Hydrogenated vegetable fats, Margarines, Dairy Fat Replacers, Confectionery fats and Exotic butters. AAK Kamani majorly uses Shea nuts as their raw material to manufacture CBE.

Wilmar International

Wilmar International Limited operates as an agribusiness company in the People’s Republic of China and internationally Wilmar specialty fats products include cocoa butter equivalents (CBE), cocoa butter replacers (CBR), cocoa butter substitutes (CBS), specially formulated filling fats, creaming fats, ice-cream fats, milk fat replacers, shortenings, margarines, frying fats and many tailor-made fats to suit customers’ requirements widely used in chocolate coating fats, chocolates, sugar confectionery, bread, pastry, cakes, cream filling (for candy, wafers, biscuits) and coffee whitener.

3F Industries

3F has been in the Exotic Fats business since 1975 and since then 3F has been providing exotic fats from Shea nuts to the confectionery industry. 3F sources Shea nuts from farm gate in West African countries of Benin, Ghana, Burkina Faso, Ivory Coast, Mali and Nigeria. It largely supplies to CBE manufacturers Japan, Malaysia, Italy, Holland, UK & the Scandinavian countries.

Manorama’s Strength

Globally, largely CBE is made from Shea nuts which are available mainly in the West African region. However, CBE can also be produced from other tree borne seeds like Sal, Mango, Kokum, Dhupa etc which are available in India. The most suitable raw material i.e. Sal seeds are available only in India and that too in abundance. Manorama is the only player in India which is capable of manufacturing CBE from Sal seeds given its procurement strength. Hence, the global players will find it difficult to compete with Manorama in the Indian context.

Barriers to entry

Since the products of the company are ultimately used for human consumption, the Chocolate manufacturers or cosmetic manufacturers give a lot of weightage to the long term relationships compared to pricing. Hence, the entry barrier to take away customers by reducing prices is very very high.

Additionally, the by-products produced from processing of Sal / Mango / Kokum i.e. De-oiled Cake, Soap Grade Oil etc. also have a huge market in India which improves realisation far better compared to any manufacturer in other developed countries thereby giving Manorama to be more price competitive in the international market compared to other producers.

As per Indian regulations, CBE manufacturing is permitted only from Indian Sal, Mango, Kokum, with a high import duty for Shea based fats. Any new player coming in the market has to go through at least 3-4 years waiting period for obtaining all customer and regulatory approvals to supply the material

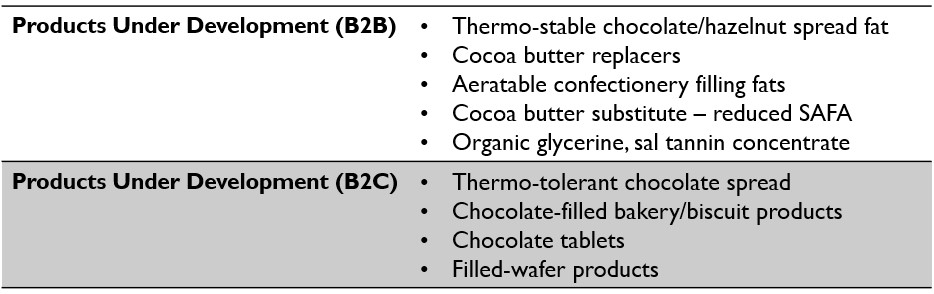

New Products

The company is looking at entering the business-to-consumer (B2C) segment and are currently developing a range of new products for this.

In the business-to-business (B2B) segment the company has developed a heat-tolerant CBE (CBE-HT) for tropical countries, which improves thermo-stability of the chocolate product. Likewise, CBE without palm component has also been developed to replace conventional CBE for different chocolate products.

Through extensive customised solution provider and with co-development approach with customers and in-house research, Manorama Industries Limited has developed a number of customised products as given below:

These premium products go into the making of world’s finest chocolate and confectionery brands.