Negative Crude Oil Prices | Reasons and Future

ARTICLE NO : 9

Why was the crude quoting at a negative price on April 20th?

On April 20th for the first ever time in history, we saw the price of the crude oil fall below zero. This is absolutely unheard of. Let us try and understand why the crude oil fell below zero, its general implications, and potential impact on the Indian stock market.

Oil is generally a volatile commodity and its price depends on numerous factors. Hence OPEC tries to control the supply in such a way that the oil prices remain stable. However, in early March due to disagreement between Russia and Saudi led to a price war; both the countries started producing huge amounts of oil in an attempt to obliterate the other (Saudi started producing 10Million Barrels of oil a day and was ramping up). The demand for oil however, throughout the world due to COVID, is shrinking continuously and this immediately led to a 30% drop in crude price in a single day. Slowly the crude price kept coming down and was inching closer to 20$ a barrel.

Different crude benchmarks

There are three main crude benchmarks:

- Brent crude oil Benchmark: Crude oil extracted from the North Sea near Norway and the United Kingdom is sold at the Brent crude oil Benchmark. Crude oil of this region contains a high percentage of sulfur which is good to extract diesel of good quality. Two-thirds of the world’s crude contracts are signed in this Brent crude oil benchmark.

- WTI Benchmark: Oil of this benchmark is extracted from American oil wells. It is transported through a pipeline and stored in Oklahoma, USA. It is used to make low-sulfur gasoline and low-sulfur diesel. It is lighter due to its lower API gravity and sweeter due to lower sulfur.

- Dubai and Oman Benchmark: Oil extracted from Arab countries is sold by referencing this benchmark.

Futures contracts for Oil and why was it quoting a negative price?

Businesses that require oil in huge quantities generally sign an agreement with oil producers to buy a certain amount of oil at a present price. This helps the businesses to protect themselves against volatility associated with the oil price. Commodity traders tend to speculate about the oil prices and attempt to use the volatility to their advantage by trading in the futures market. The big catch here is the trader doesn’t need the oil (Imagine what would people like you and me do with 1000 barrels of oil? Yes! That’s the minimum lot size!) instead he/she hopes to sell off the contract to some company that actually has some use for the oil. Because the oil demand has been so low and supply has been enormous, most reserve storage meant for storing crude in the world is full.

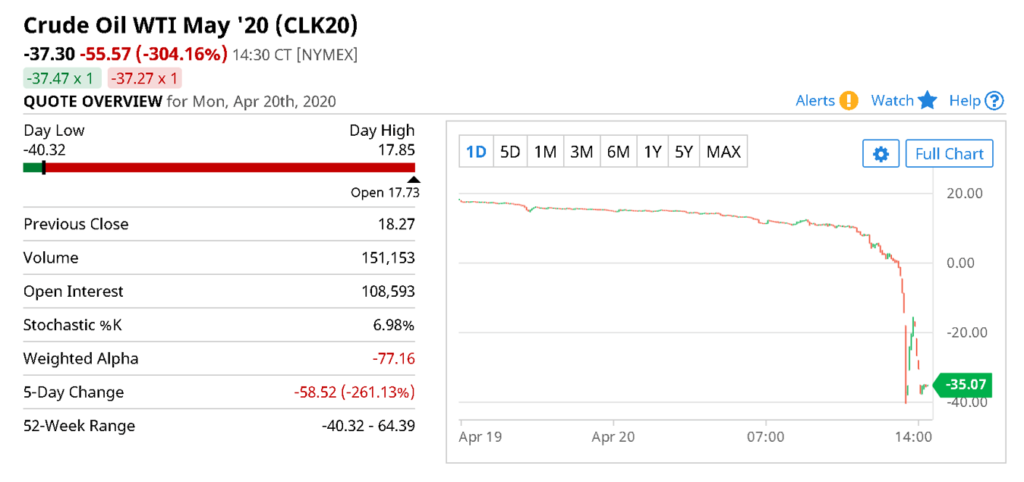

Typically, these futures contracts expire on the 20th of the month and if I buy an oil futures contract and oil prices shoot up, then the contract is worth a lot of money as many people would be willing to buy it. However, on the contrary, if I hold a futures contract and am not able to find a willing buyer, then I will need to meet my obligation and accept delivery! (For the curious, the WTI crude transaction happens at Cushing, Oklahoma (US) a month later). Now given that the supply is huge and storage spaces meant for oil fast dwindling, finding buyers at even zero was difficult on the 20th of April! This meant that we were even willing to pay money to anyone who bought their contracts. This was the reason for the crude futures contract quoting negative prices on April 20th. We want to reiterate here that the spot price of the crude did not go below zero and since Oil is a commodity, it never will! So please do not harbor hopes that someone is going to give you money if you “buy” the crude (note that the June futures are already positive).

What does this mean for India?

Falling crude prices are typically good for India. For every $ of crude price reduction, under normal demand, the government of India makes about 50K Crores (provided they do not pass on the price cut to the consumers). However, given that the demand is so low everywhere, the best India can do is to buy and store oil. The current storage capacity in India is about 67 days worth of Oil that is required by the country and there are articles that indicate that India is striving to increase the storage to 87 days Although falling crude prices are usually good for us, beyond a certain point we no longer can take advantage of cheap oil.

If the crude price remains low for a long period, then it is definitely a big positive for India.

Impact on Indian Stock Market

Companies that produce oil in different forms will take a huge hit (examples: ONGC, IOCL, OIL, etc). This is because the cost of manufacturing for these companies is very high. Refineries sector will also face some headwinds in the short term (example: Reliance, Bharat Petroleum, HPCL, etc). But as they phase out their inventory, the losses will subside. The Companies that consume or require crude to manufacture their products will benefit. Examples of such sectors are Paints (Asian Paints, Berger, etc), Adhesives (Pidilite), Airlines (Indigo, SpiceJet), Plastics (Finolex, Nilkamal), Tyres (Balkrishna Tyres, MRF, JK Tyre). One Important thing to note here is that Airlines might not get the full benefit of falling crude prices as there are hardly any operations underway currently.

But make sure you complete your analysis and then only take decision to buy stocks in these sectors. You can read about our investment philosophy here.

Complaints against MCX by Indian Brokers

Most of the commodity trading in India happens in the MCX exchange. Due to the lockdown, the exchanges reduced trading timings from 11:30 PM to 5 PM in the evening. What this means is that the customers and brokerage firms were exposed to the risk of not being able to react in cases of sharp move in commodity prices. April crude on MCX was at around 1436 per barrel on April 17th, Friday closing (one lot of crude is 100 barrels and this translates to 1,43,600 per barrel). The contract prices started falling on the Monday morning itself and when the MCX exchanges were closed at 5PM, the contract value had fallen to 96,500 per lot. However worldover the crude contracts were still falling while MCX remained closed and finally crude closed at $-37. That would mean Indian Crude oil April contracts that were not closed prior to 5PM would open at Rs -2,880 per Barrel.

Since these future contracts do not require the customers to deposit the full cost of the contract and they require only a certain percentage of the actual value of the contract to purchase it (about 57% now). So between 5 PM on April 20th and the next day, because the markets were closed and Crude fell below the “margin calls”, the onus is on the brokerage firms to pay the MCX. According to some reports, there were 11,100 contracts open at 5 pm yesterday on MCX, which means a potential loss of over Rs 330 crores for the Commodity brokerage firms over and above the margins placed by customers. Because of this chaos, some brokerage firms (such as Motilal) have lodged a complaint against the MCX.

I have uploaded video on crude, you can watch it here.

What was your experience during this episode of crude ? Let me know in comment below.

Regards,

Shashank