How to read annual reports ?

ARTICLE NO : 3

Welcome back all of you, some of you requested me to explain about annual reports, thus i have already created a video regarding the same. You can check it. But video has its own limitations so here i will be explaining you about them in detail and i will keep adding new learning here so you can access all the information at single place,stay tuned !

Lazy Retail Investors Don’t read annual reports

As Jim Rogers said ” If you get interested in a company and you read the annual report, you will have done more than 98% of the people on Wall Street. ” Annual letters is 100 to 300 page document which contains all the information about a particular company. As it is such a lengthy document most of retailers and even some of brokers don’t read it generally and most of them focus only on profit and loss statement and revenues of the company. If any particular stock has had a good growth in last 3-4 years along with improvement in revenues then most of retailers start jumping into those stocks and even brokers also advice those stock to clients,due to which huge momentum gets created in it and after the party gets over and stock starts plunging, poor retailers don’t know where to run !

Analyzing profit and loss statement is only half truth, there are many other things which one should read in annual reports which will give clarity to investors before taking any investment decision.In last 1 to 1.5 years more than 200 auditors of different listed companies resigned and stock prices crashed after that ! Retailers are still wondering what went wrong ? If you will check some of the companies were debt free, they had good profits and revenues and even then stocks got corrected more than 80% from there all time high. We will discuss on some of these cases. But before that let us first understand what is annual report and how one can read and what things one should read in annual report and which ones can be avoided ?

What is Annual Report ?

Annual Report is document which contains all information related to company starting from promoters, auditors, products, about their bankers and financial reports like balance sheets, profit and loss statements and cash flow statements and many other things.Annual report is published once in a year. For recent FY 2019 which ended on 31st march 2019, most of managements generally post their annual reports till July-August of same year. You can get these annual reports on that company website or on nse/bse website, we at valueeducator also providing you annual reports of the listed companies which you can check here.

As annual report is published by company,and it is signed by auditors so all the data mentioned in it is considered authentic and accurate ( expect forward looking statements). It is mandatory for listed companies to prepare annual reports and post themonce in a year, so investor can get required information from it.

What to read in annual reports ?

As we discussed already, annual report is lengthy document of 100 to 300 page, so what you should focus on and what you should avoid ? Let’s discuss about it.

These are the very important sections one should read in annual reports:

1)Initial Page

2)Managing Director/ Chairman letter

3)Management Remuneration

4)Management Discussion and Analysis

5)Financial Statements :

a)Profit/ Loss statement

b)Balance Sheet

c)Cash flow statement

So let’s discuss about all of them in detail.

Initial Page :

Initial page of annual report generally gives the information about how company started , who is the founder of the company and names of promoters who are running company at present,their qualification of promoters and details of independent directors.

For example you can check following example of avanti feeds 2019 annual report :

Here they have described their own journey from the start of the company.They explained year wise how company has grown and what are they expansions they have done in this time period.

Chairman/ Managing Director letter :

We get this letter from Chairman/ Managing Director in annual report’s starting pages. As a minority shareholders we must know what our top management is thinking and what is their vision about the company. One should check if chairman or managing director giving any aggressive guidance about their future profits and revenues. Because there are many managements who gives aggressive targets and then they fail to achieve them. We try to figure out it by comparing these letters with competitors. We generally avoid those stocks for which management give aggressive targets and only focused on growth. Growth is important but at the same time all the systems should be in place to achieve and maintain that growth.

If you will check current financial crisis in NBFCs due to liquidity, many of them were growing at a huge rates for last 3 to 4 years and now suddenly their growth has stopped, what the reason for it ? In lending it not important how much you lend, there will be always customers who will need loans, so there is no problem with demand. Lender must be very cautious to whom he lending and focus should be on recovery part of it.If the recovery mechanism is not set then it does not matter what is growth in loan book, sooner or latter that bubble bursts !

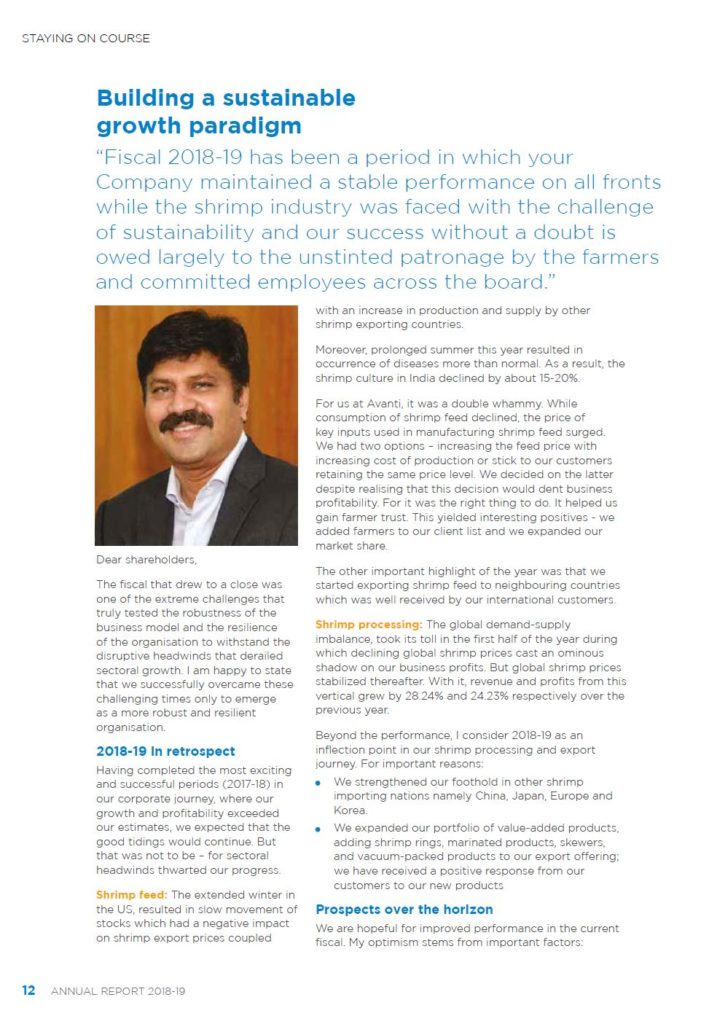

You can check following example for avanti feeds letter from Mr. Alluri Indra Kumar Chairman and Managing Director :

Management Remuneration :

Management Remuneration means how much salary management is taking out of the business. There are 2 types of managements one is founder driven while other is professional management. If founder is running the company then we don’t think its good to take out huge salaries from own company. “Only Professionals take salaries,owners don’t. They earn through dividends and appreciation in shareholding” But in India things are bit different. Let’s discuss few practical examples :

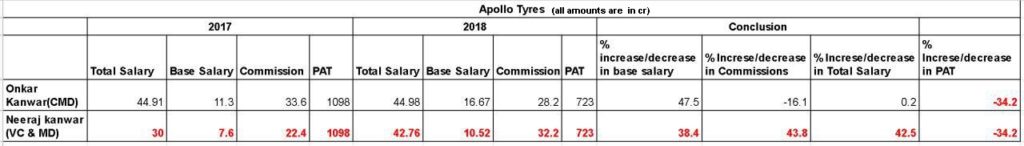

1)Apollo Tyres :

Generally management increase their own salary if the Net profit of company increases. There are some rules regarding under the Companies Act 2013. Let’s discuss them:

- If there is only one whole time director of company then he can not take more than 5% of company’s net profits of that financial year.

- If there are more than 1 whole time directors, then all together salary should not exceed more than 10% of net profits of that financial year.

But if you will check in this case of apollo tyres in 2017 they posted net profits of 1098 Cr and Neeraj Kanwar (VC&MD) salary from commission was 22.4 Cr and total salary of 42.76 Cr. But in 2018 they posted net profits of 723 Cr which reduced by 35% but at the same time VC salary increased by 44% in commissions , so this is not good corporate governance.

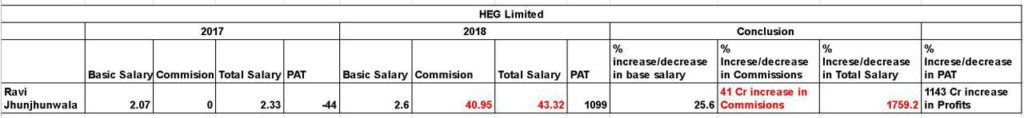

2) HEG Limited :

Here is another example on Management remuneration part. In 2017 HEG posted loss of 44 Cr and at that time Chirman salary was 2.07 Cr while in 2018 HEG posted huge profit of nearly 1100 Cr and Chairman Salary jumped up from 2 Cr to 43.32 out of which 40.95 Cr was commission. Question is why net profits of HEG and other Graphite electrodes related stock increased ? In china there was shutdown on plants to reduce pollution so there was very less supply for graphite electrodes and HEG LTD got benefited of it, now is there any management expertise in this ? We don’t think so, it was a one time situation which occurred once in company’s 40 year history. So taking such huge salaries is not best practices of corporate governance.

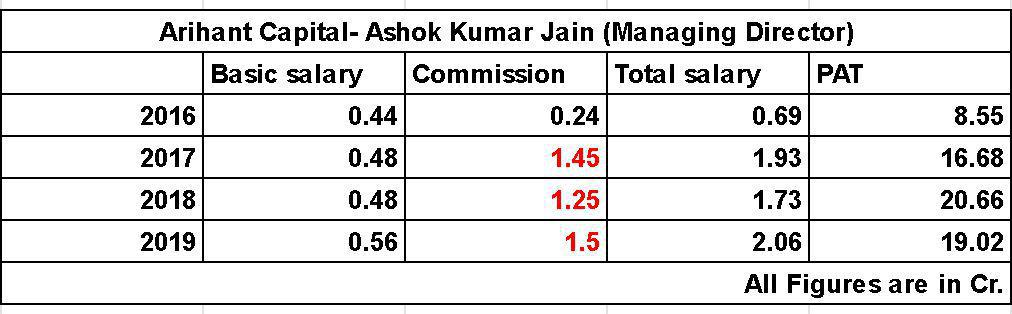

3)Arihant Capital Markets Ltd.

We will discuss another example of management remuneration. Check the following image of arihant capital market’s management remuneration.

Here, Managing director of arihant capital limited took salary of 1.5 Cr in 2018 when net profits of company were 19.02 Cr while in 2017 salary was 1.73 Cr and company’s profits was 20.66 Cr. If you will check there is increase in commission from 1.25 Cr to 1.5 Cr in 2018.There is another whole time director in arihant capital and Management all together taking almost 10% of net profits. It is as per rules but, its not the best practice.

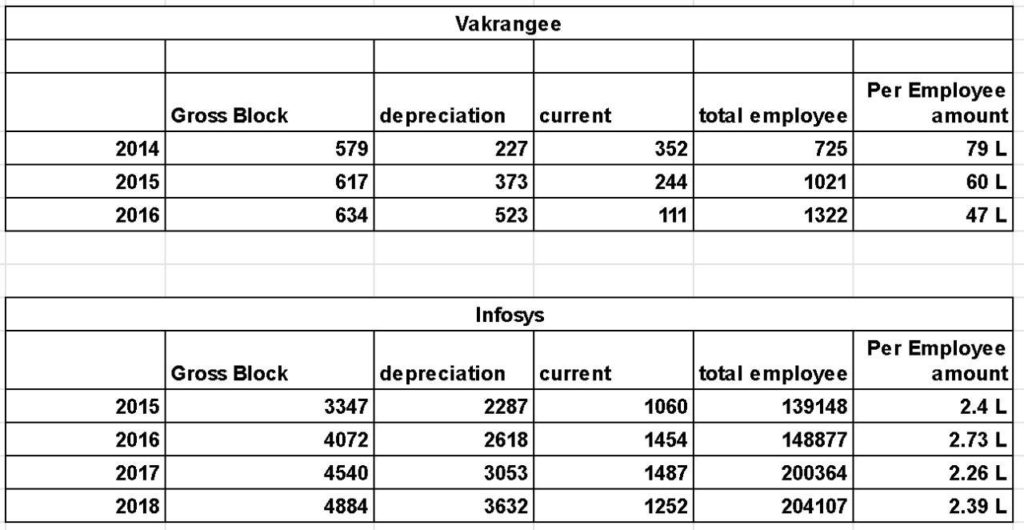

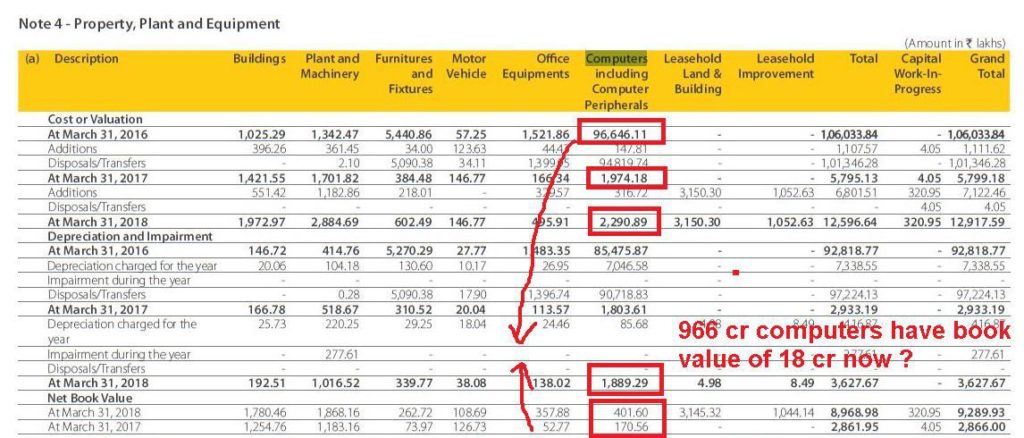

Vakrangee Capex on Commuters :

Here we will disucss another interesting case regarding corporate governance. Please check following image on how much Vakrangee vs Infy invested in computers.

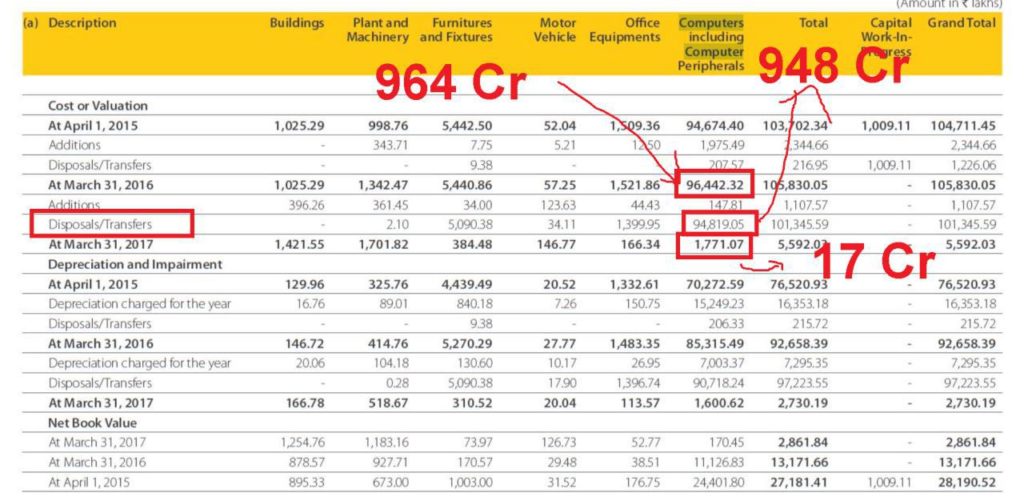

In 2014 Vakrangee mentioned they have total investments of 579 Cr in computers while in 2015 and 2016 it was 617 and 634 Cr Respectively. You can check the after depreciation amount. ( Depreciation is not cash expense, which means computers were there and not sold). At the same time in 2014 they have reported total employees of 725 in 2014, 1021 and 1322 in 2015 and 2016 respectively. If we will do simple math of gross block/total employee then per employee cost of computer comes to 79 L, 60L and 47 L in respective years. While if you do same calculation for infy it comes nearly to 2.4 L. In Vakrangee case it was not justified which computers they were using and why they have spent so much amount in computers? It is not the end of the story,check the following images which are taken from 2017 and 2018 annual reports, which indicate got computers worth 948 Cr disposed/transferred, while net cost of computers at the end of 2017 was 17.71 Cr and 2018 it was 18.89 Cr. (check following images)

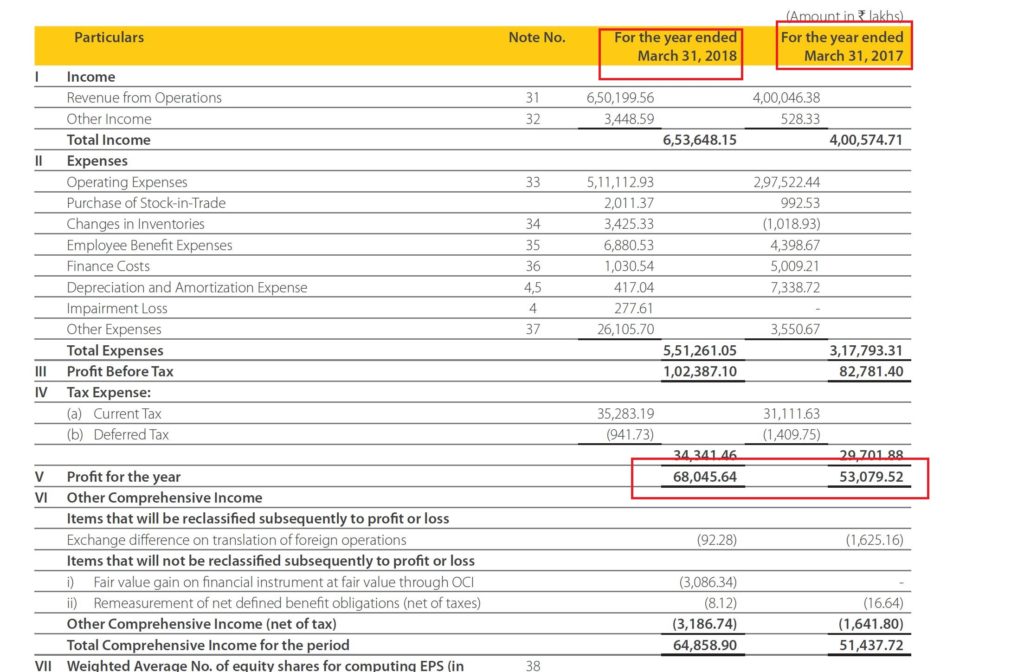

Let’s check vakrangee’s profits posted in 2016,2017 and 2018. Please check following images, you can see that in 2016 they posted net profit of 394 Cr which increased to 530 Cr in 2017 (growth of 34 %) and further it increased to 680 Cr. (growth of 28 %) . While revenues also increased from 3196 Cr in 2016 to 4005 Cr in 2017 and 6536 Cr in 2018, at the same time the company does not have the debt. During Jan 2018 Vakrangee had market cap of 50,000 Cr around price of 500 Rs per share while current market cap is 3500 Cr at 32 Rs price per share, which is 93% of wealth destruction. So lesson here is just not to check profits and revenues one should deeply read,annual reports also to avoid such situations.

(Check following images)

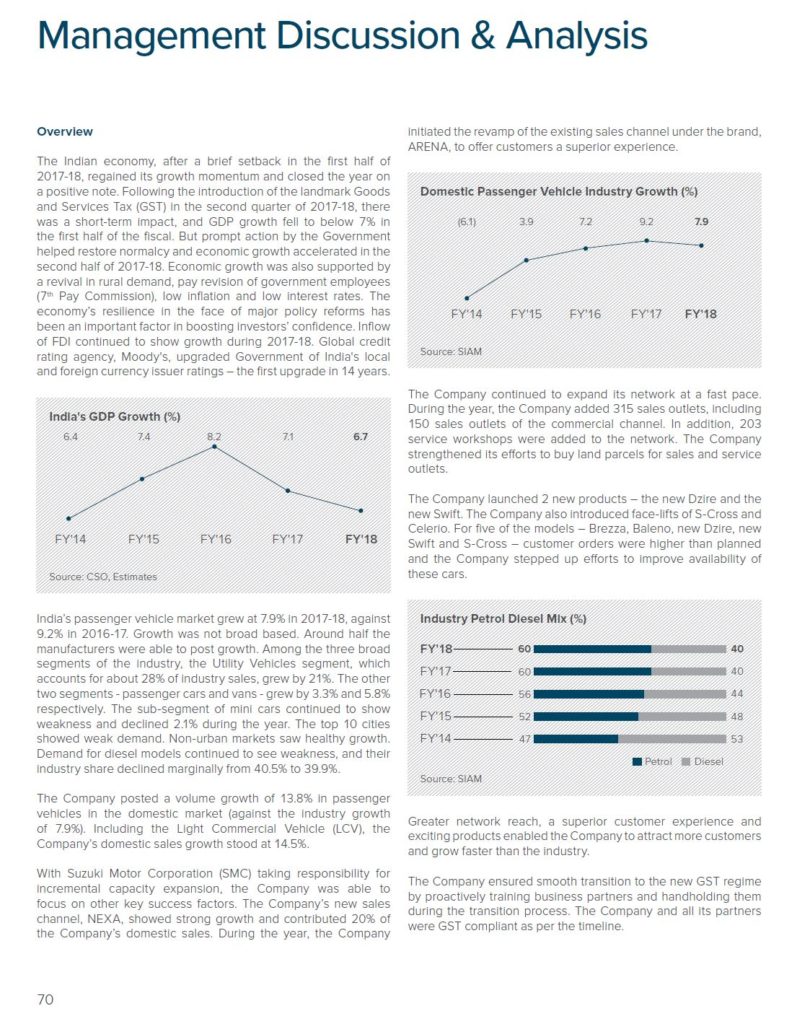

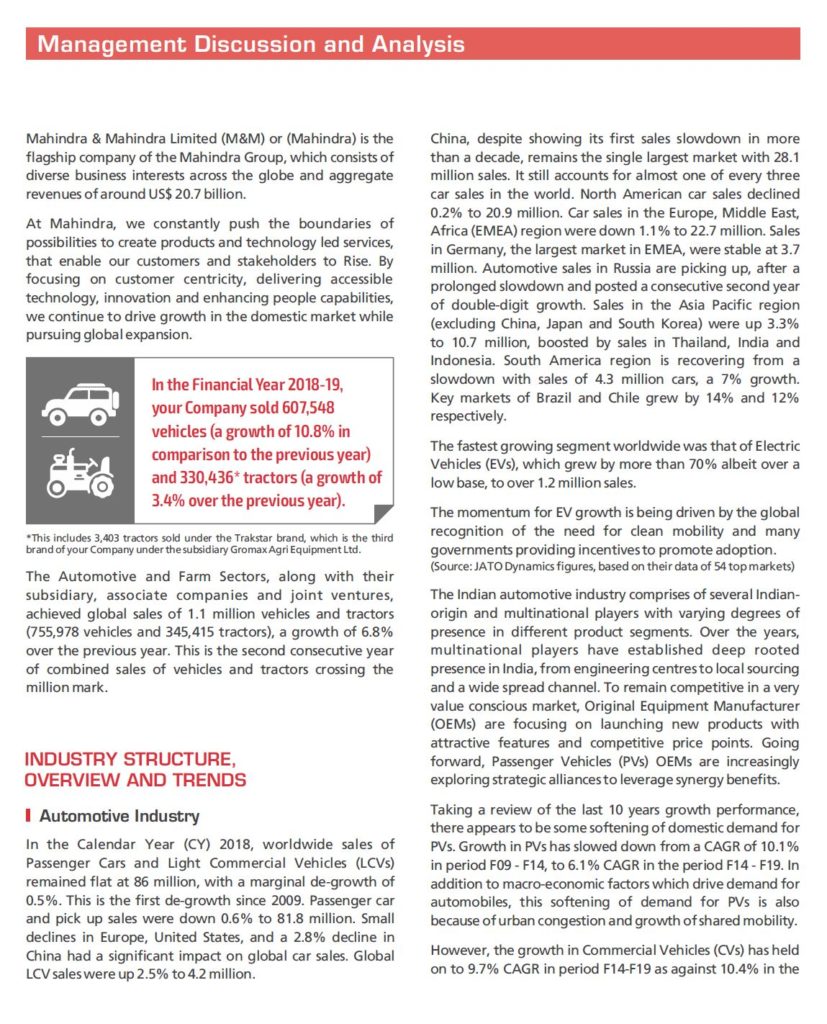

4) Management Discussion & Analysis :

Let’s discuss the last point on how to read in annual report ( For first part of article) which is management discussion and analysis. This is the most important part of annual report . Here management gives their own views on global and Indian economy then they discuss on their own sector and what is the position of their business in it. These 5-6 pages are very important by which we can understand current the scenario of sector and about the particular business, How management is planning their growth? What are their products? What are the challenges and how they going to face it ? What will be the future expansions and how it will help the company? What are current profit margins and what should be the range for future margins and many other things are discussed in this section.

If you are studying business of Maruti which is in the Automobile sector, then its beneficial to read annual reports of tata motors and M&M which are in the same sector. We should be aware of competitors and what are their future plans.We can compare profit margins, growth rate, new product launches, Overall sector views, Future expansion with the competitors which give us clarity about particular business and help to take decision of buying that stock or avoiding it.

Following are some of the images for management discussion in automobile stocks:

MARUTI

TATA MOTORS

Mahindra & Mahindra

So that’s it in this article, I will write Separate Article on How to Read financial Statements (Balance Sheets, Profit and Loss statements and Cash flow)

Let me know if you looking for any improvements, feel free to contact me if you need any help.(value.educator@gmail.com)

Value Educator

[Your Wealth Doctor]