- Price pressures and syringe shortage plus other supply chain issues (Impact of shortage of API and primary packing materials) witnessed in the US. Management expects the new launches to normalize the impact.

- Ensured timely new product launches and commercialized key products such as Bortezomib, Pemetrexed, Pantoprazole and Cyanocobalamin in the US market.

- Received 180 days CGT exclusivity for Zinc Sulfate injection in the US market. Marketing Date : 27 June 2022

- Commercialized Auxiliary platinum in the Canadian market

- Key products- Enoxaparin sodium, Ketorolac tromethamine and Ertapenem

- Guidance – Launch of 7 products in the next 3 quarters ~$1.3bn (Opportunity Size)

- There have been very few syringe manufacturers in the US that are approved. Gland got affected due to supply shortages of syringes.

- Non-exclusive contracts pertain mainly to products that are small and less complex.

- Exclusive contracts are generally for products that are complex and have a sizable market opportunity where the market share of the partner is sufficient. In the scenario where the market share of the partner is insufficient or of a poorly performing partner,

- Gland can void the exclusive agreement and manufacture for multiple partners.

- Rest of world markets :

- Delay in material supplies impacted the ability of Gland to take up orders with low delivery time.

- The key markets contributing to the growth continue to remain MENA, LatAm and APAC.

- Registered Ethacrynate Sodium, Ganciclovir, Foscarnet sodium and Labetalol Hydrochloride in new geographies

- Management expects the growth of the Row markets to normalize because demand hasn’t been an issue but supply has been.

India :

- Shutdown of dedicated insulin line taken for increasing the line productivity impacted quarterly sales

- Higher input costs due to supply side challenges Gland’s core portfolio also impacted sales conversion.

- India sales were lower as compared to Q1 FY22 because of higher base due to Covid products like Remdesivir and Enoxaparin Injection in that quarter

- Gland Pharma got revenues of 51 cr of revenues in Q1 23 vs 200 Cr in Q4 22

- Previously there were export restrictions on Enoxaparin product, so they were domestically supplying to these third parties. These 3rd parties contributed to around 100 cr of revenue but with lower margins. Now the costs have gone up (logistics+dollar) so supply to 3rd parties have stopped which has impacted their domestic sales.

- Qtrly revenue from India is expected to be ~ 100 Cr [Front end B2c – 60 Cr, Insulin – 30 Cr, inaudible – 10 Cr]

- Covid related sales have been lost in the Indian market ( 80 cr of revenues from Indian Geography)

Geographic expansion :

- China remains a key geographic focus and they expect to start receiving approvals for at least a couple of products during the current year – Addressable market size of ~$1bn.

- Expanding penetration in markets such as a South Africa and Kazakhstan

- Received first-to-file (FTF) for two filed products during Q1 FY23 with a US market size of ~ $ 145 million

- Investing in new manufacturing lines for technologies involving microspheres and combi-vials to support complex development of products.

Other Details :

- Micafungin last quarter – INR 126cr. This quarter – No supply because the customer is liquidating inventory

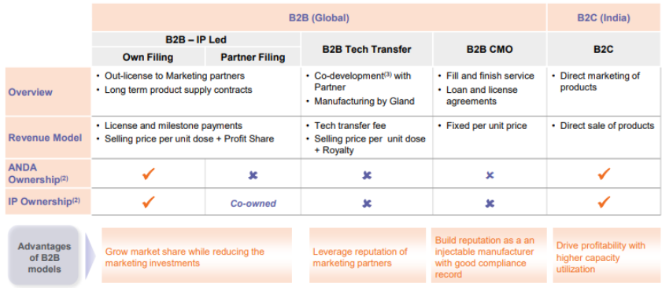

- Shifting the business model from filling ANDAs by Partners to filling ANDAs by themselves. [ Gland gets marketing rights if they file the ANDAs themselves ]

Impact of supply chain issues – US -Revenue loss of 25 cr Row ~Revenue loss of 100cr India ~Revenue loss of 40cr ( Plus 80 cr due to covid and around 30 cr due to demand issues)

China :

- Filling of 5 products in FY23 and 6 to 7 products in FY24

Biosimilar :

- Biosimilar revenue – Not meaningfully adding any numbers yet. Biosimilar Revenues are expected from end of this year

Tenure of the contract :

- Small contracts (Year or so as Gland has just entered this market.)

Margins in the next 2-3 years :

- Guidance – 33-35%

IP led model

- Profit share ~ 40-50% of net profit

Tech transfer

- Royalty ~5% of net sales (No profit share)

Conclusion :

Better to avoid when business trades at high valuation with highest profitability when less entry barriers !

- Register for model portfolio to get detailed analysis of various businesses.