Introduction

- Neogen chemicals ltd. was founded in 1991 by technocrat Harish Kanani.The company has expertise in bromine and lithium chemistries.

- The products manufactured are served for pharmaceuticals, agrochemicals, engineering industries, speciality chemicals companies in India, Europe, Usa, and Japan.

- Increasing the revenue contribution from Custom Synthesis and Contract Manufacturing segments.

Promoter Background

- IIT graduate and technocrat promoter Mr Haridas Kanani had set up India’s first bromine plant in 1968, but it failed as the plant was hit by floods caused by Morbi dam. Lack of knowledge in business kept him away from insuring the plants.

- Later years he worked as an engineering consultant for manufacturers to set up the bromine plants for others.

- In 1989 the technocrat decided to set up Neogen chemicals Pvt. Ltd. and started the manufacturing of bromine compounds.

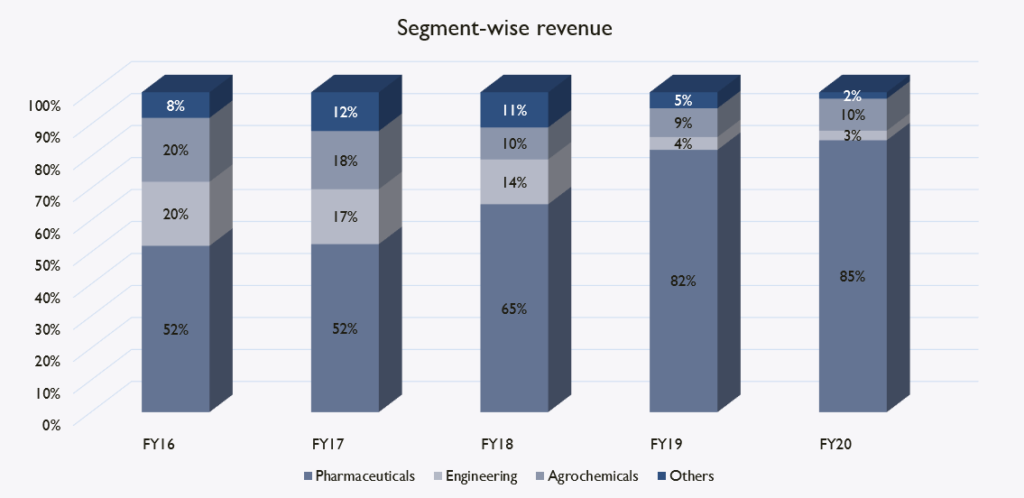

Revenues from end industry

- The products manufactured by Neogen find application in Pharmaceuticals, Engineering, and agrochemical business. More than 85% of revenues are driven from the pharmaceutical industry, thus the demand for products is expected to stay secular.

Business segment Contribution

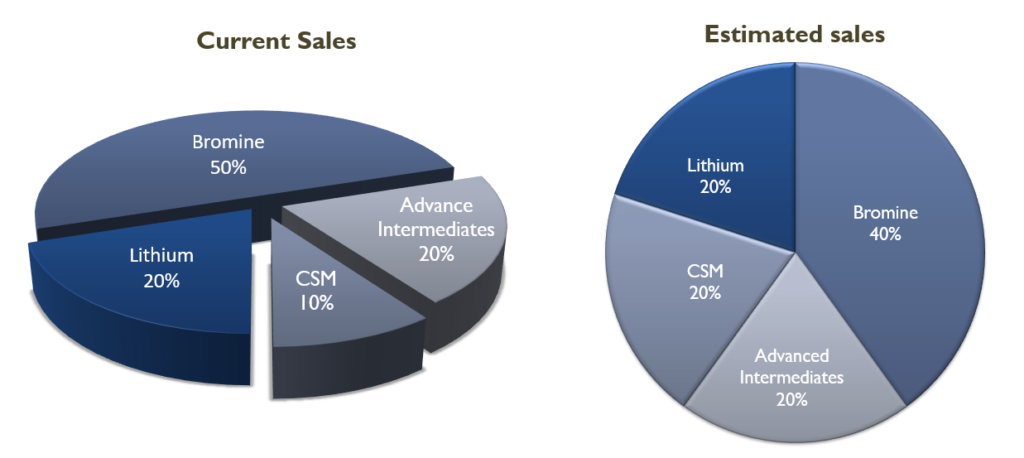

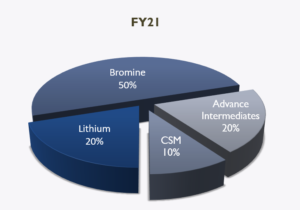

The company has 4 major business segments of which bromine contributes the highest revenues followed by advanced intermediates, lithium and CSM business.

- History Bromine as a halogen.

- Bromine was discovered by two German scientists in 1825, since then bromine is widely used in pharmaceuticals, water treatment, fire safety and the rubber industry

- Bromine is the third lightest halogen and is a fuming reddish-brown liquid at room temperature. It is the only nonmetallic element that is a liquid at room temperature.

- It’s position in the periodic table is right below Chlorine and right above iodine, thus it falls under halogen chemistry.

- Availability of bromine and global sourcing

- Bromine is extracted from seawater, brine well, groundwater, salt lakes

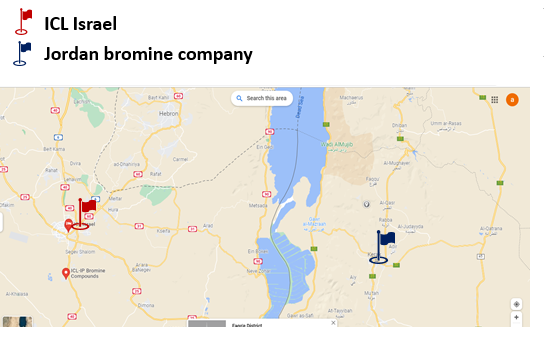

- Global reserves: Bromine is abundantly found in the dead sea. The high salt content of the sea makes it the most suitable feedstock for manufacturing of bromine.

- Dead sea splits the two countries Jordan and Israel leaving them with high deposits of bromine.

Leading Global manufacturers of bromine are:

- Albemarle in USA in JV with Jordan bromine company

- ICL (Israel)

- Chemtura in USA which was acquired by Lanxess in 2017

- Domestic Reserves: Bromine deposits are in Rann of Kutch in Gujarat. In 2018 the government allowed manufacturers to extract bromine.Bromine in India was majorly manufactured by Solaris Chem tech. Neogen had acquired Solaris Chemtech in 2017

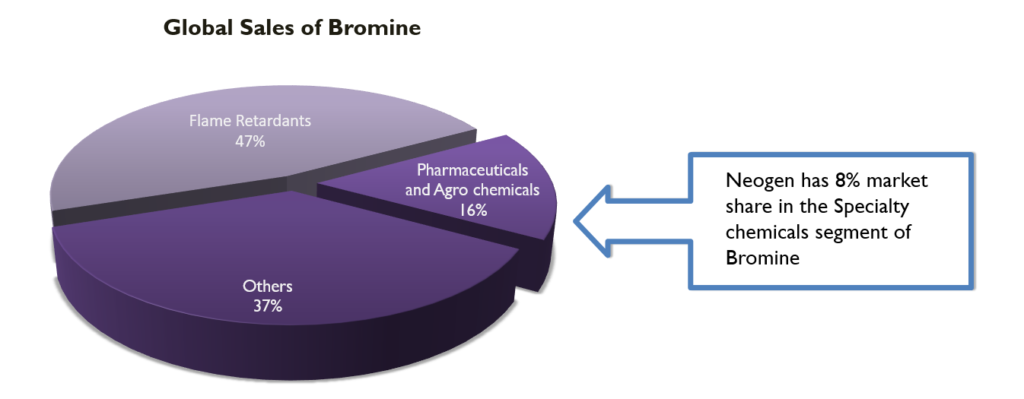

Industry Size and opportunity

The bromine is widely used in flame retardants, followed by pharmaceuticals and other products. Neogen does not have application in fire retardants and focuses more on pharmaceutical products.

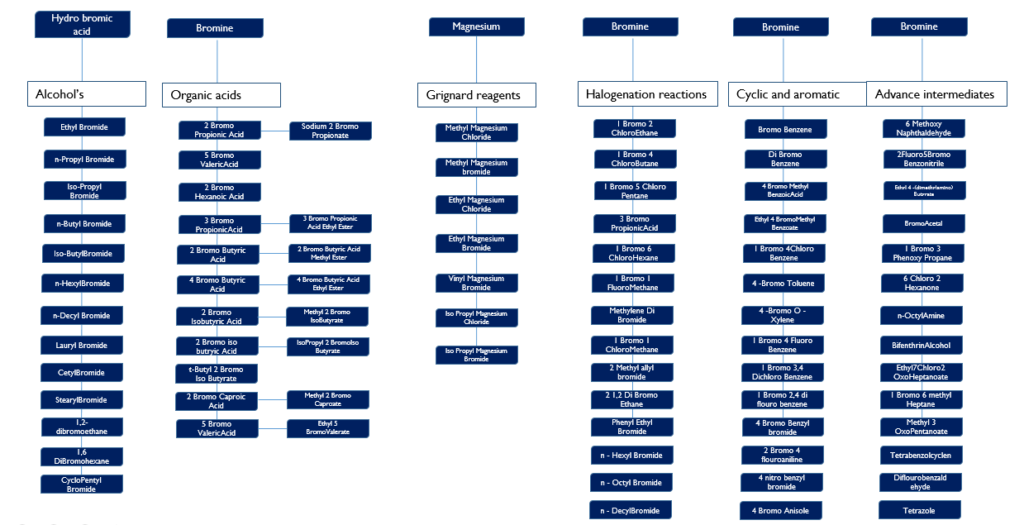

Bromine Value Chain

Manufacturing downstream products of bromine results in value addition and high margin products

Lithium

Introduction and uses

- Lithium is the third element of the periodic table and was discovered in 1817. Lithium has wide application in battery chemistry for electric vehicles, pharmaceuticals, polymers and fine chemicals and many others. Lithium is extracted in two forms of minerals –Lithium carbonate sourced from concentrated salt water brines & Lithium Hydroxide which is sourced from hardrock spodumene

- Lithium is scarce in India and hence dependent on imports for raw lithium

Application Lithium bromides in refrigeration

- Lithium Bromide is widely used in compressor air-conditioning chillers

- Absorption chillers are used mostly for large installations when electricity is limited and/or heat is abundant. Absorption chillers can be used for both heating and cooling purposes

- The LiBr solution is used in HVAC systems due to it’s strong affinity for water vapour because of its very low vapour pressure. With upcoming capacities in electrolyte chemistry will be driver for demand.

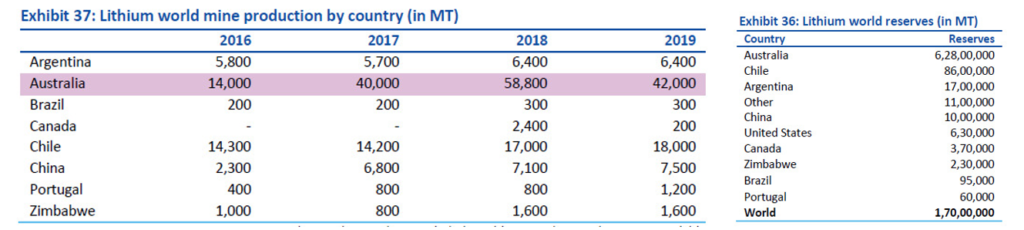

Global manufacturers and deposits and Lithium production

- Lithium deposits are largely found in south American region of Argentina, Chile, Bolivia contributing 45% to global markets

- Australia also has large deposits of lithium – about 40% of global market Some of the leading global lithium manufacturer are:

- Albemarle (USA)

- Tianqi Lithium (china)

- Sociedad Química y Minera de Chile (chile)

- Pilbara Minerals

- Jiangxi Ganfeng Lithium Co. Ltd. (china)

Global production and lithium prices

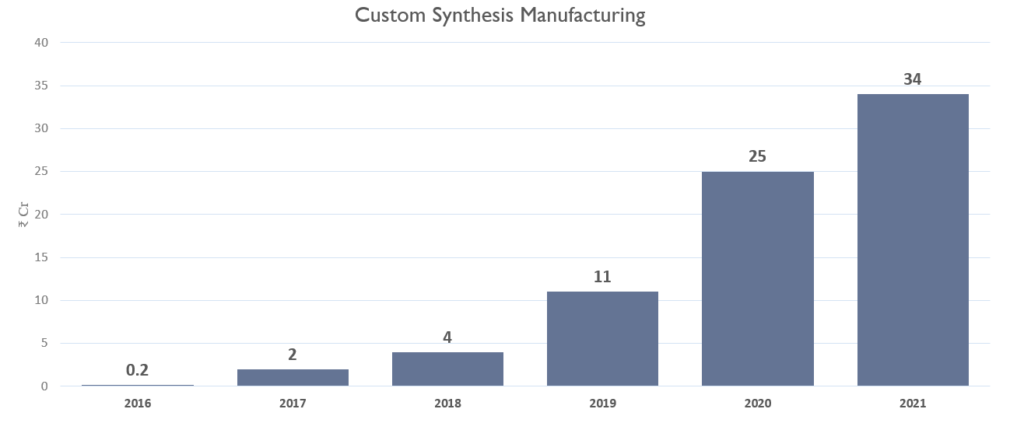

Custom Synthesis manufacturing CSM

- Custom synthesis the innovator outsources the basic chemistry of the molecule to the manufacturer and he is responsible for large scale production of that molecule. In some cases Neogen may not be directly associated with the final innovator. Neogen develops the molecule for the companies like Divis and Hikal and these companies have contacts with global innovators

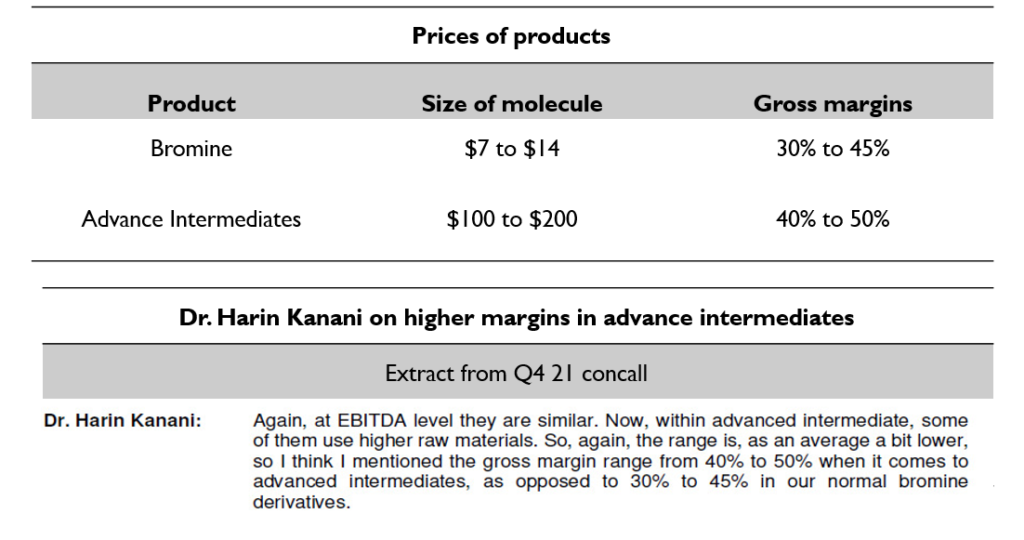

- Due to This value addition final molecule prices can go up to $100-200$ as complexity of chemistry increases as these molecules are produced according to customer requirements and hence margins for Neogen also increases

Revenue from CSM

Advance intermediates

Advanced intermediates make up 20% of revenue for Neogen and this segment has high margins. This is achieved because of strong R&D and manufacturing of complex molecules.

Changes in revenue mix

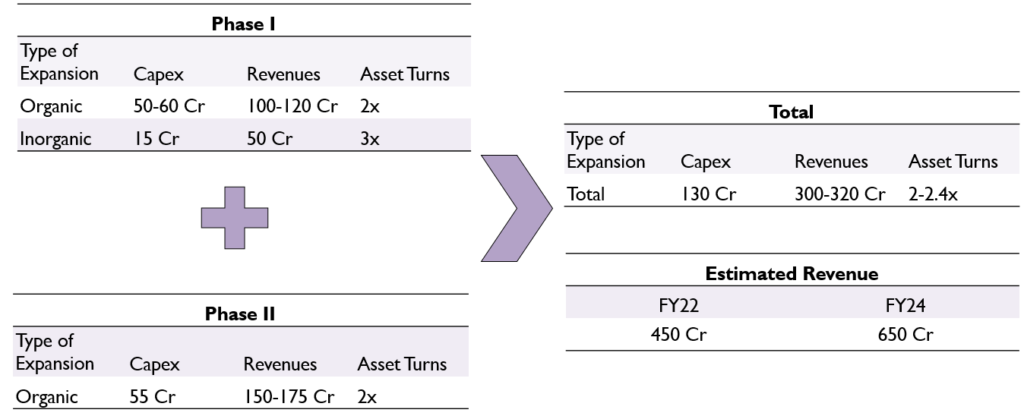

The company is focusing on increasing the revenue contribution from CSM and Advance intermediate business. The revenue contribution from CSM is expected to rise from 10% to 20%

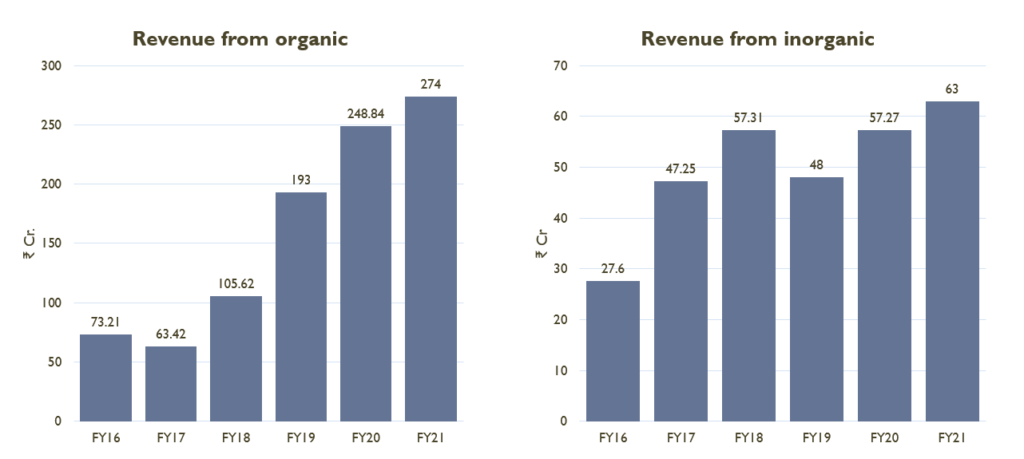

Revenues from organic and inorganic business

The company classifies the business as organic and inorganic where organic business is from Bromine products and inorganic business is from Lithium products.

Product diversification in the business

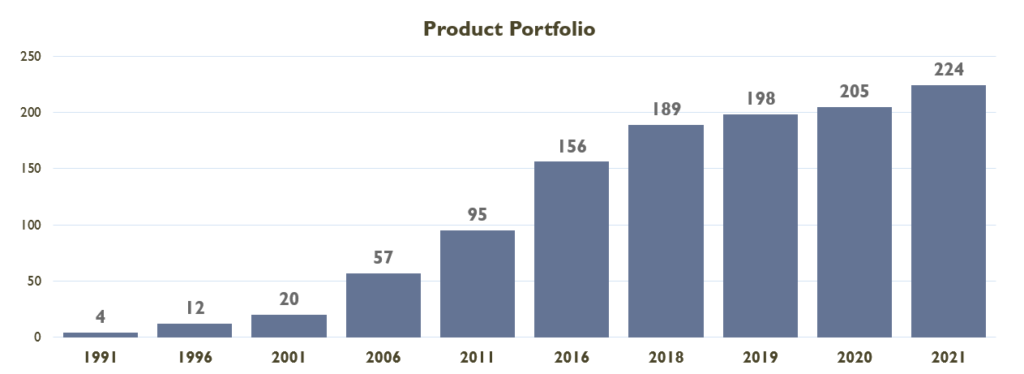

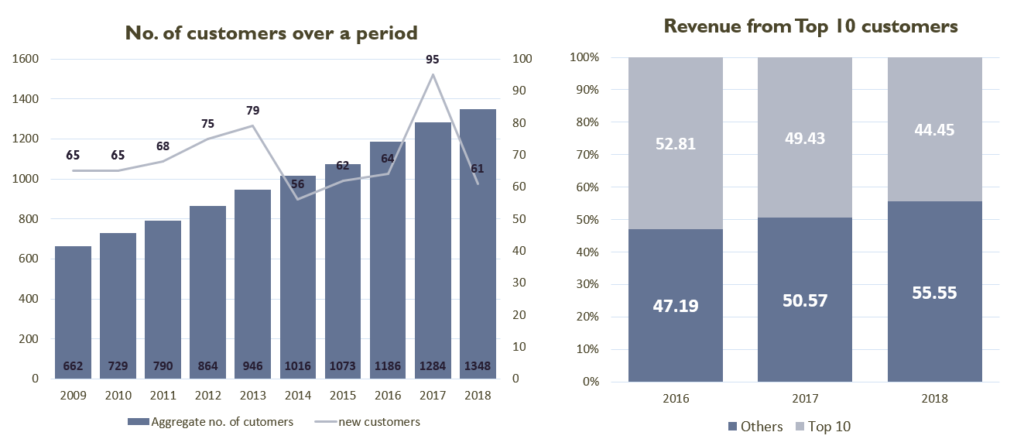

Neogen started with a mere 10 Products. Today, they have a diversified portfolio of more than 200 products.

Manufacturing process

Competitive advantage

- Neogen makes small molecules in which they have 85% market share. Sometimes even 100%. But those molecules have only that much demand.

- Initially the orders from the clients for molecules were ranging from 7$ to 25$, now the range stands at 100$ -$200.

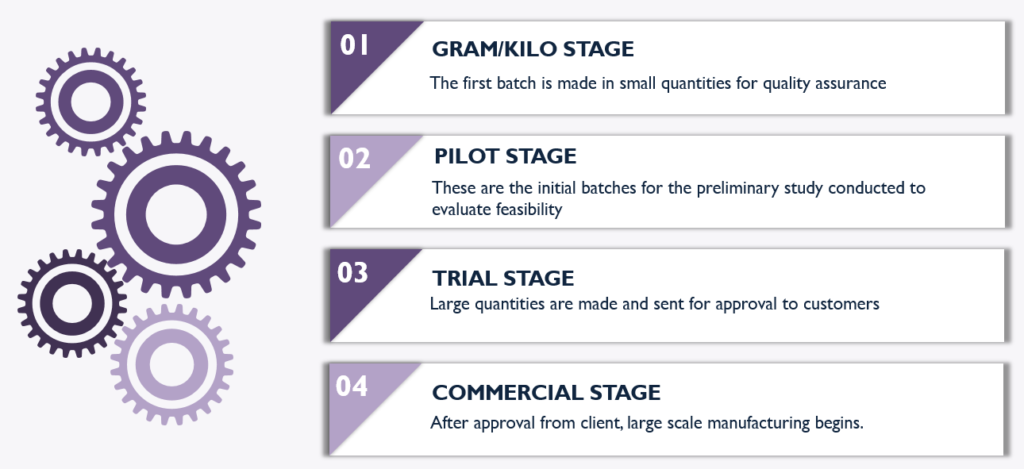

- Molecules are sent from the trial phase for quality assurance, these approvals may sometimes take as long as a year.

- For small scale manufacturers, procurement of bromine is difficult. Neogen has long term contracts with suppliers of bromine.Bromine is highly unstable and so it needs expertise to handle.

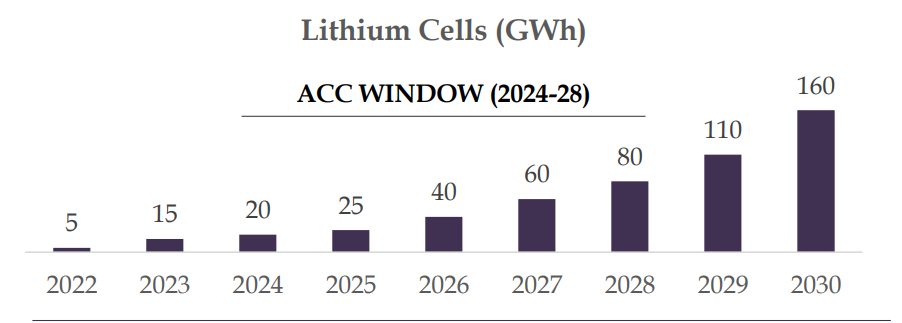

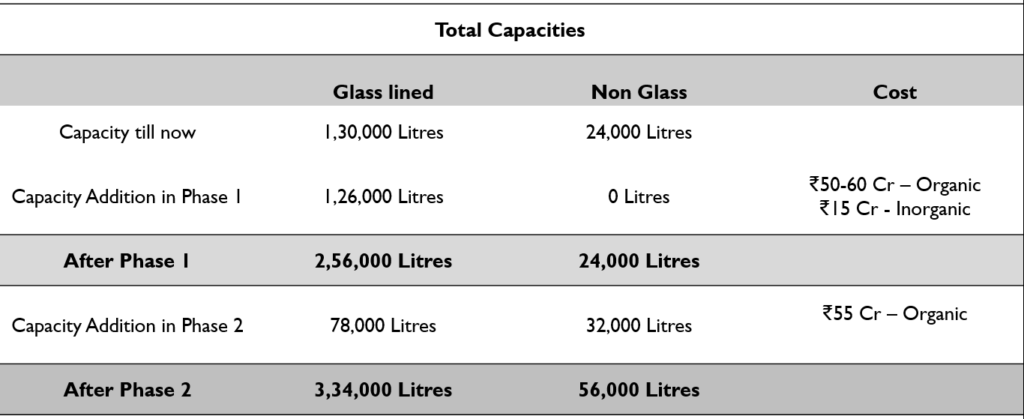

Future Capex

- New CAPEX of Rs. 35 crore that was announced in Q2 FY22 is progressing well. This is being entailed at the Vadodara facility to Manufacture 250 MT of Electrolyte for lithium-Ion batteries advanced chemistry cel

- Phase I expansion completed in Sept 2021 and Phase II expansion completed in Oct 2021for organic facility

Asset turnover

Customer concentration

Research & development

The R&D team began with 10 people and 1 PhD scientist, now it is 37 with 5-6 PhD scientists. It has two R&D facilities at Mahape and Vadodara.3 Crores in expenditure in FY2020 for research and development. Around 60% of R&D capacity is contributed to CSM products. 1% of total revenue dedicated for R&D purpose.

Revenue realisation

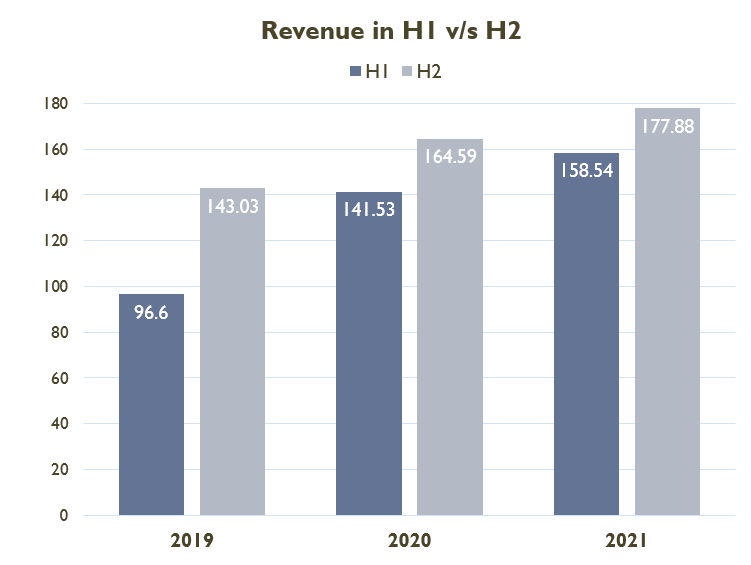

Revenue in the second half is generally higher than the first.i.e H2 > H1.As summer break hits Europe, many pharmaceutical industries pile up their inventory, thus creating a rise in demand. Also, the HVAC machines are usually depreciated in the last months of the year, this drives the demand for the inorganic segment.

Size of opportunity

- The existing opportunity of the speciality bromine segment which does not include new discovered molecules is 5000-7000 Crs.

- The agrochemical opportunity size for active ingredients and intermediates is at $5-7 billion, followed by $30 billion opportunity in pharmaceutical intermediates. Lithium has 1200 Crs of opportunity size.