- The company sold 108,922 MT of plastic goods and achieved net product turnover of INR 2,169 crore during the first quarter of the current year against sales of 71,264 MT and net product turnover of INR 1,310 crore in the corresponding quarter of previous year, achieving volume and product value growth of about 53% and 66% respectively. High volume growth because of low base last year. Company expects volume growth of 15% for FY 23

- Total consolidated income and operating profit for the first quarter of the current year amounted to INR 2,211 crore and INR 327 crore as compared to INR 1,346 crore and INR 267 crore for the corresponding quarter of the previous year, recording increase of 64% and 22% respectively.

- The consolidated profit before tax and profit after tax for the first quarter of the current year amounted to INR 268 crore and INR 214 crore as compared to INR 213 crore and INR 170 crore for the corresponding quarter of the previous year, recording increase of 26%. Company has a Cash Surplus of 533cr as on 30 June 2022.

- The company’s envisaged Capex plan for the year ’22 to ’23 of about INR 700 crore, including carry forward commitment to INR 280 crore is progressing smoothly and shall be funded entirely from internal accruals

- New unit at Guwahati (Assam) has commenced commercial production and units at Cuttak (Odissa) & Erode (Tamil Nadu) are likely to go in production by September, October 2022.

- Industry demand for PVC has gone up by 27%. The prices of different polymers particularly polypropylene (PP), low-density polyethylene (LDPE) and poly vinyl chloride (PVC), have gone down between INR 19 per kilo to INR 46 per kilo since beginning of the year till now date, that is a reduction between 13% to 32%. This sharp reduction would result in inventory losses.

- In the last Two years, PVC prices have shown tremendous fluctuations. PVC prices gone up from 70rs/kg to 160rs/kg. And now it dropped to 94rs/kg. China Produces 50% of world PVC production. China is supplying 80-90k tonne resin to India because of low demand in their country and dropping prices every week.

- This price fall will boost demand of company products. Company expects business conditions to improve from September ’22 onward and will lead to higher volume growth in Plastic Piping business in the remaining period of the year.

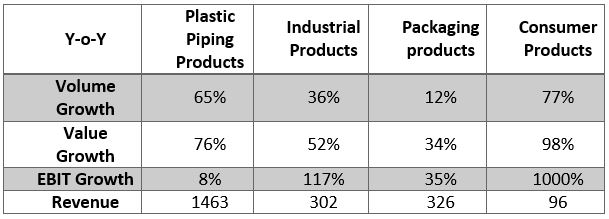

- Plastic Pipes grew 65% in volume and 76% in value. Packaging 12% in volume and 34% in value. Industrial product segment grew 36% in volume and 52% in Value. Consumer product business segment grew 77% in volume and 98% in value. Overall turnover of value added product increased to 761Cr compared to 516cr, achieving growth of 47%

Plastic pipes segment

- The company has augmented its offering in Plumbing Systems by introducing PEX plain pipe and PEX composite pipe, which are ideal pipe systems to carry hot water. All these initiatives will give required impetus to the division to grow faster and seize the growing business opportunities.

- The company continues its objective to aggressively grow Plastic Piping System business. The company is implementing Greenfield expansion, launching new applications and system and continue to enlarge its product basket along with brownfield expansion in its existing plants.

- Company’s olefin fittings ad electrophill fittings is receiving good response from nal jal scheme, which government has committed to implement throughout the country by 2024. Bath fittings is well accepted, and company expects 100% growth.

Packaging Products

- The business of Cross Laminated Film product is getting impacted by fierce competition from look-alike products. The thrust in the current year will be in promoting non-Tarpaulin applications, targeting new customers in existing markets and making breakthrough in export market where company still has to penetrate.

- In Protective Packaging division, business conditions are improving. It has started doing good business in its consumer products, sports goods, yoga mats, kids puzzle and toys. Good growth is shown in export market as well. The company expects good business for the division and continue to develop various customized solution for the user industry.

- Performance Packing Film has done well. Exports have also grown and received good response from countries in Middle East, Africa, and Europe. With improved product mix and focus on increasing customer base, the company would soon have all its capacity fully tied up and will look for expansion opportunities. The company remains optimistic in various business segments where it operates

Industrial Product segment

- In Industrial Component division, business conditions are showing signs of gradual improvement. Company expect positive demand scenario in sectors of appliances like washing machine, air conditioners, cooler, refrigerator segment where it has good presence. Material handling division has been able to add many new customers all over the country and would strive to continue enlarge its customer base and product portfolio.

- In Composite LPG Cylinder division, repeated orders from existing as well as new customers are encouraging. Supplies against the Letter of Intent from Indian Oil Corporation have commenced and existing capacity is running at full capacity. Work on doubling the capacity is progressing smoothly and likely to be operational by November 2022. Supplies against the Indian Oil Corporation have commenced.

Consumer Product Segment

- The company plans to launch relative new models and remain focused in the Premium Range of Plastic Furniture, which will help in overall growth in this business segment.

Supreme Petrochem

- The new plant of 80,000 tons will be in operation from September. So up to June, Company was not able to meet the domestic demand. In July, company started exporting back. It may be exporting first 5,000 ton monthly. Company is already present in more than 100 countries.

Focus

- Increasing share of value added products, which contributes around 38% of topline.

- Increasing exports. Company exports to 20 countries. Products sold in export market gives better margins.

- Register to model portfolio to watch detailed analysis on other real estate developers like ajmera realty