Introduction

- Gufic Biosciences is engaged in manufacturing, marketing, distribution and sale of pharmaceutical and allied products. They are one of the very few pharmaceutical companies that have had an extensive focus on lyophilization and are on the route of becoming the largest manufacturer of lyophilized products.

- Lyophilization is the process of removal of water from the drug product. The drug product, being unstable in water, undergoes a specialized process in which the drug is exposed to a heating process in which the water is evaporated and post that, the drug is frozen.

- At the time of injecting the frozen drug product into the patient, it is mixed with highly sterilized water.

- The company is mainly engaged in domestic business but also deals with international partners, mainly of emerging markets and Europe.

Business segment

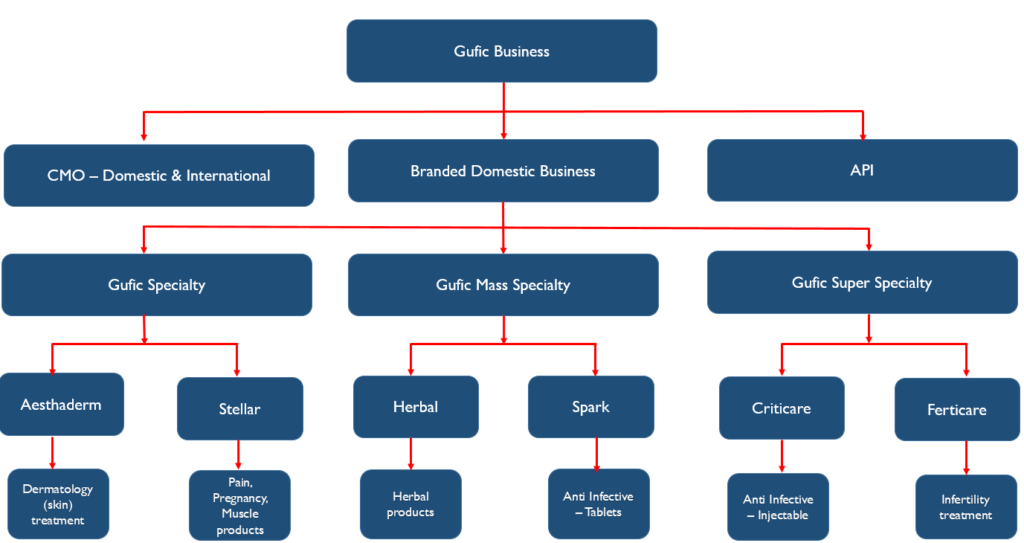

The company is involved in Branded Domestic Formulations, CMO – Domestic & International and API business.

- Under The CMO business, Gufic is involved in manufacturing lyophilized injectables for regulated as well as lesser regulated markets.

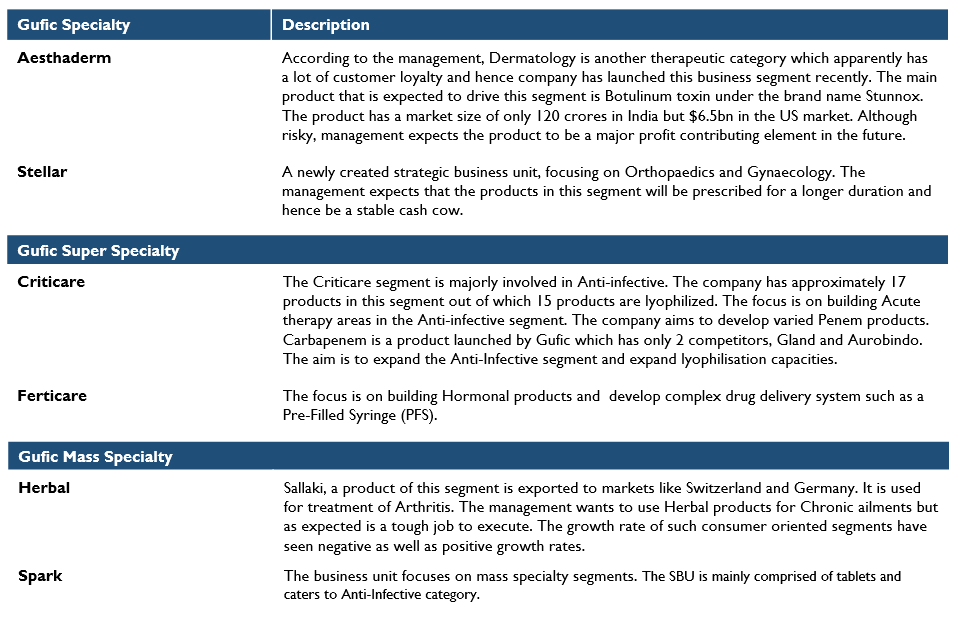

- Under the Branded Domestic Formulations Business, the business is majorly divided into 3 categories, Gufic Super Specialty, Gufic Specialty and Gufic Mass Specialty. Majority of the income comes from the Gufic Super Specialty business within which the Criticare segment is a very important business unit for Gufic. The Criticare segment has a market opportunity of around ₹3000-5000 cr and the Ferticare segment has a market opportunity of around ₹3000 cr. The therapeutic categories in this segment are majorly Anti-Bacterials, AntiFungals, Proton Pump Inhibitors, Cardiovascular, Muscle Relaxants. Other segments are Gufic Specialty under which they have Aesthaderm and Stellar and Gufic Mass Specialty under which they have Herbal and Spark division.

- Although APIs produced are sold to domestic as well as international manufacturers, the majority of the APIs produced are used for captive consumption. Around 60% of the APIs used are imported from China and the rest are produced in house. The therapeutic categories under which APIs are produced are AntiFungals, Anti-Bacterials, Anesthetics.

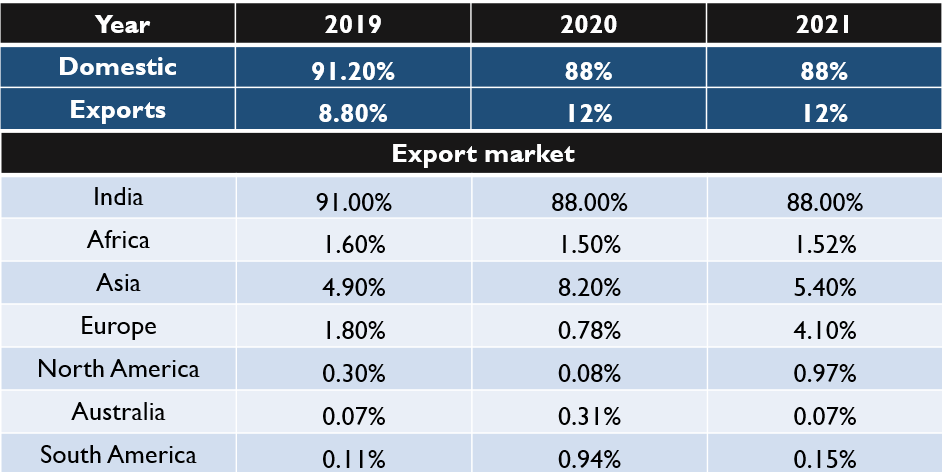

Geographical revenue

The company is majorly focused on the Indian market but has initiated business in the international markets since the past 4-5 years. It has begun exports in regulated as well as lesser regulated markets. Regulated markets like the UK, Europe, Germany, Australia and Canada are expected to be the drivers of export growth by way of increased market penetration. Less regulated markets like Africa, Southeast Asia, CIS, South Africa are expected to contribute through sale of high end life saving drugs as well as increased market penetration. Gufic is not focusing on entering the US and the Japanese market at least for the next 4-5 years.

The management’s strategy before entering any new geographical market is forecasting if they will be able to acquire a sizable chunk of the market share for that product. For instance, when Gufic entered the German market by launching Vancomycin and Clarithromycin, it acquired a market share of more than 50% for those products.

Target segment and top products

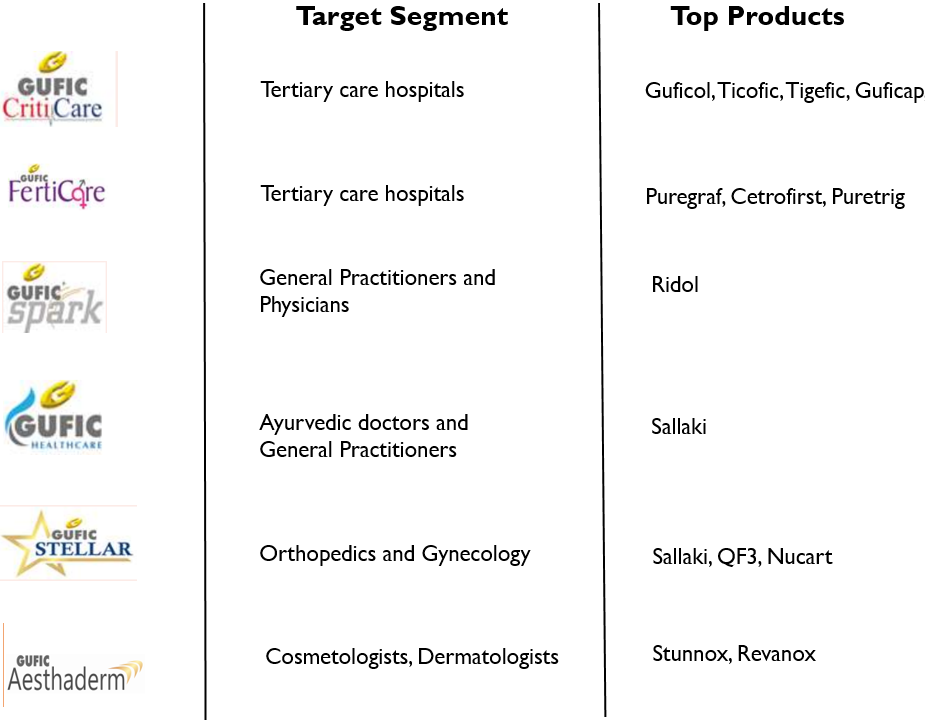

- Criticare – Focused on anti infectives that are primarily lyophilized products.

- Ferticare – Focuses on solving infertility issues in women.

- Spark – Focused on anti infectives that primarily deliver the drug in the form of tablets.

- Herbal – Herbal products to treat infections, bacteria, bone related issues.

- Aesthaderm – Focused on dermatology to treat wrinkles, skin diseases.

- Stellar – Pain, pregnancy and muscle products.

Gufic Stridden

Gufic Stridden Biopharma pvt ltd. is the International marketing and export division of gufic.

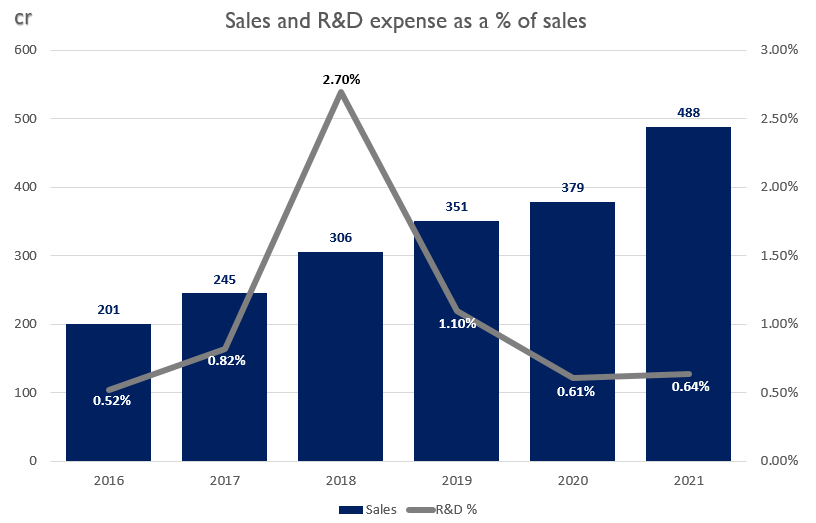

Research and development

- New molecules – Gufic has invested in research and development in therapeutic areas such as Anti-Diabetics, Cardiac, Anti-Infectives, Hormones, Neurologicals, Antifungals, Nutraceuticals, Pain management and Penems. The business strategy for the molecules is to launch the products under Gufic’s trademarks.

- Complex drug delivery systems – Gufic has been working on New Drug Delivery Systems (NDDS) in the Criticalcare and Infertility segment. They have successfully completed in-house trials on several innovative concepts in Pre-filled syringes, Dual chamber Bags and Dual chamber Syringes

- Biologicals and Peptides – Looking at the global trend towards biologicals and peptides, Gufic has identified several peptides which have great market potential in segments like Immunity (Thymosin Alpha), Cosmetic Dermatology (Botulinum toxin), Infertility (Recombinant products) and several others products in the Criticalcare segment. Several of these products would be first time launches and would be launched through proper phase –II / III clinical trials for obtaining market authorization in India and other countries.

All of this is expected to take 4-5 years, assuming the products pass the clinical trials successfully.

New ventures

- Gufic is planning to come up with a new pipeline of Criticare which are mostly targeted for primary healthcare products.

- Gufic is launching Anvil, an antidiabetic drug as management believes Gufic doesn’t have a strong foothold in the anti diabetes segment

- The company is planning to enter into Immuno-Oncology and believes it will be profitable as it could have lesser side effects than the traditional chemotherapy. This is to be accomplished within a span of 5 – 6 years.

- The API business is driven by R&D in Navsari Gujarat to develop Peptides and Cyclo-Peptides

- Gufic is also planning to set up a 30 lakh vials (lyophilized) facility. As a result, lyophilized capacity will increase, enabling Gufic to become the largest manufacturer of lyophilized injectables in the domestic market.

- In line with management’s plans to venture into NDDS, Gufic has set up their first dual chamber bags with 2.4 Cr IV bags.

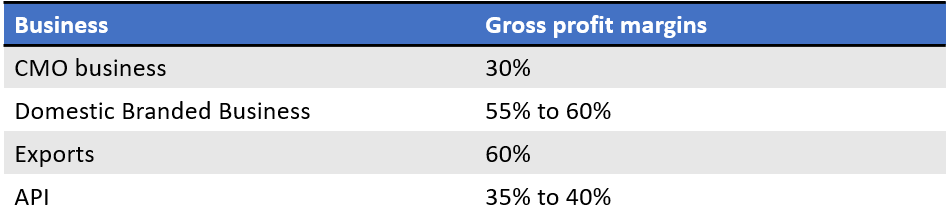

Margins

The management has given insight as to what the investors can expect the gross profit margins to be for the following businesses